Skyrocketing Profits with Real-Time Stock Data Analytics

Have you ever wondered how people make so much money in the stock market? Or what’s the secret behind those big investors who always seem to win? The answer is simple—real-time stock data analytics! In today’s fast-paced market, where prices fluctuate every moment, real-time data and its proper analysis can make you a game-changer. In this article, we’ll discuss what it is, how it works, and how you can use it to skyrocket your profits. So, let’s get started and dive deep into the details!

The Importance of Real-Time Data in the Stock Market

The stock market is a place where things change every second. Sometimes a stock’s price soars, and other times it crashes. Real-time data is the magic that instantly tells you what’s happening in the market right now. It’s completely different from historical data, which only shows past numbers. In today’s volatile market, trading without real-time data is like walking in the dark without a flashlight—a risky move.

What is Real-Time Data?

Real-time data is live information that comes directly from stock exchanges. It includes live stock prices, trading volume, market news, and much more. This data updates every second, ensuring traders know the market’s current state instantly.Real-time data is information that is collected, processed, and made available for use almost instantly, with minimal delay between its creation and availability. It’s typically generated and updated continuously, allowing systems or users to act on it immediately. Examples include live stock market feeds, social media updates, sensor data from IoT devices, or real-time traffic information. The key characteristics are low latency, high frequency, and immediate accessibility, often enabled by technologies like streaming platforms, APIs, or edge computing. This contrasts with batch data, which is collected and processed in groups at scheduled intervals.

How is it Different from Delayed Data?

Delayed data is information that’s 15-20 minutes old, or sometimes even older. In the stock market, even a one-minute delay can lead to significant losses. Imagine a stock’s price suddenly spikes, but you miss it because you’re looking at delayed data—the opportunity is gone! Real-time data keeps you updated with every market movement.

Real-time data and delayed data represent two distinct approaches to data processing and delivery, with significant differences in timing, use cases, technologies, and implications. Below, I’ll explain the differences comprehensively, starting from basic concepts and progressing to advanced details, ensuring clarity for readers at all levels, from beginners to experts.

Basic Understanding: What Are Real-Time and Delayed Data?

Real-Time Data

- Definition: Real-time data is information that is collected, processed, and made available for use almost immediately after it is generated, with minimal delay (typically milliseconds to seconds).

- Example: When you check a live stock price on an app, the price updates instantly as trades happen. Similarly, a navigation app like Google Maps shows traffic conditions as they change.

- Key Idea: The focus is on immediacy—data is fresh and actionable right away.

Delayed Data

- Definition: Delayed data is information that is collected and processed after a noticeable time lag, ranging from minutes to hours or even days, before it’s available for use.

- Example: A daily sales report generated at the end of the day, summarizing all transactions, is delayed data. Stock prices shown with a 15-minute delay on some free financial websites are also delayed data.

- Key Idea: The focus is on aggregation—data is collected over time and processed in batches, not instantly.

Key Differences: A Simple Comparison

| Aspect | Real-Time Data | Delayed Data |

|---|---|---|

| Speed | Available in milliseconds to seconds. | Available after minutes, hours, or days. |

| Processing | Processed instantly as data is generated. | Processed in batches at scheduled intervals. |

| Use Case | Immediate decision-making (e.g., fraud detection). | Historical analysis (e.g., monthly reports). |

| Example | Live sports scores, IoT sensor readings. | End-of-day sales summaries, archived logs. |

| Complexity | Requires advanced systems for low latency. | Simpler systems, less demanding infrastructure. |

| Cost | Higher due to real-time infrastructure. | Lower, as batch processing is less resource-intensive. |

Detailed Breakdown for All Levels

1. Timing and Latency

- Real-Time Data:

- Beginner Explanation: Imagine you’re watching a live cricket match on TV. The score updates as soon as a run is scored. That’s real-time data—there’s no wait.

- Intermediate Explanation: Latency (the delay between data creation and availability) is extremely low, often 1-100 milliseconds. This is critical for applications like autonomous vehicles, where a split-second delay could cause accidents.

- Advanced Explanation: Real-time systems aim for sub-second latency, often using event-driven architectures and stream processing frameworks (e.g., Apache Kafka, AWS Kinesis). Latency is minimized through in-memory processing and optimized network protocols like WebSockets or MQTT.

- Delayed Data:

- Beginner Explanation: Think of getting a newspaper that reports yesterday’s cricket match results. The information is useful but not immediate.

- Intermediate Explanation: Latency can range from minutes (e.g., 15-minute delayed stock quotes) to hours or days (e.g., monthly sales reports). Data is stored, aggregated, and processed in batches, often at scheduled times.

- Advanced Explanation: Delayed data relies on batch processing frameworks like Apache Hadoop or ETL (Extract, Transform, Load) pipelines. Data is typically stored in databases or data warehouses (e.g., Snowflake, Google BigQuery) before processing, which introduces intentional delays for efficiency.

2. Processing Approach

- Real-Time Data:

- Beginner: Data is handled as soon as it arrives, like a chef cooking your order right after you place it at a fast-food restaurant.

- Intermediate: Real-time processing uses streaming technologies to handle data as a continuous flow. Systems process each data point (or small groups of points) as they arrive, without waiting to collect a large batch.

- Advanced: Stream processing frameworks like Apache Flink or Spark Streaming process data in micro-batches or true event-by-event streams. These systems use distributed architectures to handle high-throughput data, often integrating with message brokers like RabbitMQ for efficient data flow.

- Delayed Data:

- Beginner: Data is collected over time, like waiting until the end of the day to count all the money a store earned.

- Intermediate: Batch processing collects data over a period (e.g., an hour, day, or week) and processes it all at once. This is less resource-intensive but slower.

- Advanced: Batch processing often uses MapReduce-based systems (e.g., Hadoop) or cloud-based ETL tools. Data is stored in a staging area, transformed (e.g., cleaned, aggregated), and loaded into a database or data warehouse for analysis, often scheduled via tools like Apache Airflow.

3. Use Cases

- Real-Time Data:

- Beginner: Used when you need information right now, like tracking a delivery truck on a map or getting instant notifications on your phone.

- Intermediate: Common in scenarios requiring immediate action:

- Finance: Real-time stock trading or fraud detection.

- Healthcare: Monitoring heart rate via wearables.

- E-Commerce: Live inventory updates or personalized recommendations.

- Social Media: Real-time post updates on platforms like X.

- Advanced: Critical in latency-sensitive applications like high-frequency trading (HFT), where algorithms execute trades in microseconds, or IoT systems where sensors trigger real-time alerts (e.g., industrial equipment failure detection).

- Delayed Data:

- Beginner: Used when you don’t need the data immediately, like checking how many people visited a store last month.

- Intermediate: Common for historical or analytical purposes:

- Business Intelligence: Generating quarterly sales reports.

- Marketing: Analyzing campaign performance after a week.

- Log Analysis: Reviewing server logs to identify issues.

- Advanced: Used in data warehousing for large-scale analytics, such as trend analysis or predictive modeling, where data is aggregated over time to identify patterns (e.g., using SQL queries on a data lake).

4. Technology and Infrastructure

- Real-Time Data:

- Beginner: Needs fast computers and networks to process data instantly, like a super-fast internet connection for live video calls.

- Intermediate: Relies on technologies like:

- Streaming Platforms: Apache Kafka, AWS Kinesis.

- Message Brokers: RabbitMQ, Redis Pub/Sub.

- Databases: InfluxDB (time-series), MongoDB (real-time queries).

- Protocols: WebSockets, MQTT for low-latency data transfer.

- Advanced: Real-time systems often use distributed architectures with edge computing (e.g., AWS IoT Greengrass) to process data closer to the source, reducing network latency. In-memory databases and event-driven serverless functions (e.g., AWS Lambda) ensure rapid processing. Scalability is achieved through distributed clusters and load balancers.

- Delayed Data:

- Beginner: Uses regular computers to process data later, like saving all your emails and reading them at the end of the day.

- Intermediate: Relies on:

- Batch Processing Tools: Apache Hadoop, Spark Batch.

- Data Warehouses: Snowflake, Google BigQuery, Amazon Redshift.

- Scheduling Tools: Apache Airflow, cron jobs.

- Advanced: Batch processing systems are optimized for throughput, not latency. They use distributed file systems (e.g., HDFS) and parallel processing to handle large datasets. Data is often partitioned and processed in chunks, with results stored in relational or columnar databases for querying.

5. Cost and Complexity

- Real-Time Data:

- Beginner: More expensive because it needs powerful systems to work fast, like buying a high-speed gaming PC instead of a basic laptop.

- Intermediate: Requires investment in high-performance hardware, cloud services, and specialized software. Maintenance is complex due to the need for fault-tolerant, scalable systems.

- Advanced: Costs are driven by the need for low-latency infrastructure (e.g., high-speed networks, edge devices) and real-time monitoring tools. Ensuring high availability (e.g., 99.99% uptime) adds complexity, requiring redundant systems and disaster recovery mechanisms.

- Delayed Data:

- Beginner: Cheaper because it doesn’t need to be super fast, like using a regular printer instead of a high-speed one.

- Intermediate: Batch processing is less resource-intensive, as it can run on standard servers or cloud instances during off-peak hours. Simpler to implement and maintain.

- Advanced: Costs are lower due to less stringent performance requirements. Systems can use commodity hardware or scheduled cloud jobs, with less need for real-time monitoring or redundancy.

6. Data Quality and Accuracy

- Real-Time Data:

- Beginner: Since it’s processed so fast, there’s less time to check for errors, like sending a text without proofreading.

- Intermediate: Real-time systems prioritize speed over perfection, which can lead to occasional inaccuracies (e.g., missing a few data points in a live stream). Data validation happens on the fly.

- Advanced: Real-time data pipelines often include lightweight validation (e.g., schema checks) but may sacrifice deep cleaning for speed. Techniques like event deduplication or anomaly detection are used to maintain quality.

- Delayed Data:

- Beginner: There’s more time to check and clean the data, like editing a letter before mailing it.

- Intermediate: Batch processing allows for extensive data cleaning, transformation, and validation, resulting in higher accuracy for analytical purposes.

- Advanced: ETL pipelines include robust data quality checks, such as outlier detection, data normalization, and reconciliation, ensuring high reliability for reporting and analytics.

7. Examples in Real Life

- Real-Time Data:

- Beginner: When you post on X, your followers see it instantly. That’s real-time data at work.

- Intermediate: Examples include:

- Live sports apps updating scores as the game happens.

- Smart thermostats adjusting temperature based on real-time sensor data.

- Credit card fraud alerts triggered during a suspicious transaction.

- Advanced: High-frequency trading platforms process market data in microseconds to execute trades, or autonomous vehicles use real-time LiDAR and camera data to navigate.

- Delayed Data:

- Beginner: A monthly phone bill shows all your calls and data usage from the past month—that’s delayed data.

- Intermediate: Examples include:

- A retailer analyzing last week’s sales to plan inventory.

- A website reviewing monthly traffic reports to improve design.

- A company generating annual financial statements.

- Advanced: Enterprises use delayed data for data warehousing, where historical data is aggregated for machine learning models or business intelligence dashboards.

Advanced Considerations

- Hybrid Approaches:

- Some systems combine real-time and delayed data. For example, a bank may use real-time data for fraud detection but delayed data for monthly account statements.

- Lambda Architecture: Combines real-time (speed layer) and batch processing (batch layer) to balance latency and accuracy.

- Kappa Architecture: Focuses solely on stream processing, treating batch data as a special case of streaming.

- Real-time systems require distributed architectures (e.g., Kubernetes clusters) to handle high data volumes and ensure uptime. They use techniques like data partitioning and replication.

- Delayed systems can tolerate downtime and use simpler, centralized architectures.

- Security:

- Real-time data is more vulnerable to breaches due to its continuous flow, requiring encryption (e.g., TLS) and secure protocols.

- Delayed data can be secured during storage and processing, with more time for audits and compliance checks.

- Industry Trends:

- Real-Time: Driven by 5G, edge computing, and AI, real-time data is growing in IoT, autonomous systems, and smart cities.

- Delayed: Still critical for big data analytics, compliance reporting, and long-term forecasting, but less dominant in fast-paced industries.

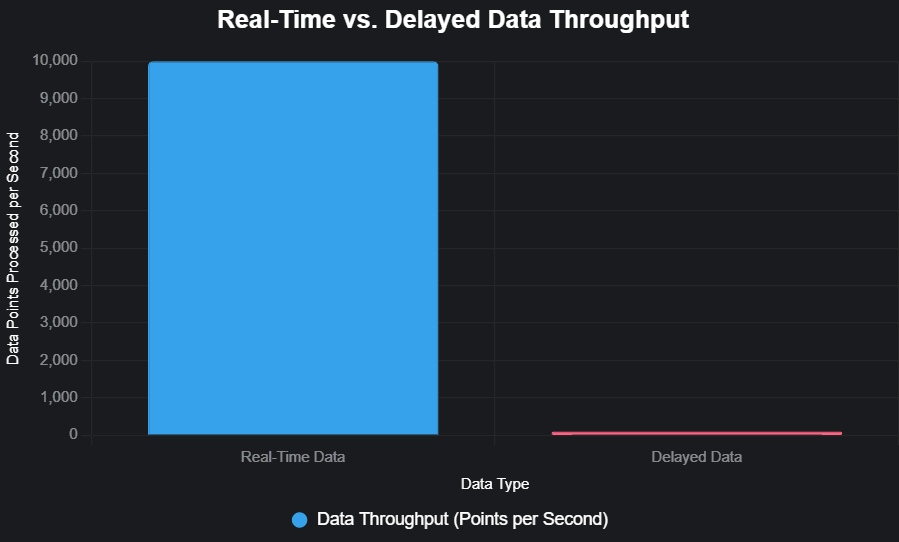

Visualizing the Difference

To illustrate the difference in data volume processed over time, I can generate a chart comparing real-time and delayed data processing rates. Would you like me to create a bar or line chart showing, for example, data throughput (data points per second) for real-time vs. delayed systems? Here’s a possible chart if you confirm:

This chart shows real-time data processing significantly more data points per second than delayed data, highlighting the speed difference.

Real-World Example from X

- Real-Time Data: On the X platform, when a user posts, it appears in followers’ feeds instantly, and likes/comments update in real time. This relies on streaming data pipelines.

- Delayed Data: X might generate a report on monthly trending topics, aggregating post data over weeks, which is processed and delivered later.

If you’d like, I can search X posts or web sources for specific examples of real-time vs. delayed data applications to provide more context.

Analytics: The Game-Changer in Stock Trading

You’ve got the data, but how do you make sense of it? That’s where analytics comes in. Simply put, analytics is about understanding data and extracting useful insights. In the stock market, it tells you which stocks have potential, when to buy, when to sell, and what the market’s mood is.

How Does Analytics Work?

Through analytics, you can turn massive real-time data into concise, understandable insights. There are several methods:

- Technical Analysis: Predicts future prices using charts and patterns.

- Fundamental Analysis: Evaluates a company’s true value by analyzing earnings, revenue, etc.

- Sentiment Analysis: Gauges what the market feels—bullish or bearish.

The Role of Technology

Today, advanced tools like machine learning and AI analyze thousands of data points in seconds. These provide accuracy that’s impossible to achieve manually. Plus, they spot trends and opportunities that the human eye might miss.

Real-Life Example

Imagine a trader monitoring a stock’s price movement. Analytics indicates that the stock could rise in the next two hours because trading volume is increasing and sentiment is positive. The trader buys immediately and sells when the price rises—locking in a profit!

Read more:

- The Beginner’s Guide to AI Stock Trading Success

- How to Earn Passive Income Online with Print-on-Demand Stores in 2025

Benefits of Real-Time Data for Skyrocketing Profits

Real-time data offers significant advantages for businesses aiming to boost profits by enabling faster, more informed decisions, enhancing customer experiences, and optimizing operations. Below, I’ll detail the benefits of real-time data specifically for skyrocketing profits, structured from basic to advanced concepts to ensure clarity for all readers. I’ll also provide a practical example wrapped in an artifact to illustrate how real-time data can be leveraged, such as a dashboard for monitoring sales metrics.

Benefits of Real-Time Data for Skyrocketing Profits

1. Faster Decision-Making for Competitive Advantage

- Basic: Real-time data lets businesses react instantly to changes, like adjusting prices during a sales surge, helping them beat competitors.

- Intermediate: By analyzing data as it’s generated (e.g., customer purchases or market trends), companies can make quick strategic decisions, such as launching flash sales or redirecting marketing budgets to high-performing channels.

- Advanced: In industries like e-commerce or finance, real-time analytics enable dynamic pricing models (e.g., Uber’s surge pricing) or high-frequency trading, where split-second decisions based on live market data can yield massive profits. For example, hedge funds use real-time stock data to execute trades in microseconds, capitalizing on tiny price movements.

- Profit Impact: Faster decisions mean capturing opportunities before competitors, leading to higher revenue and market share.

2. Enhanced Customer Experience and Loyalty

- Basic: Real-time data helps businesses give customers what they want right away, like showing product recommendations while they shop online, making them more likely to buy.

- Intermediate: Real-time personalization, such as tailored product suggestions or targeted ads based on live user behavior, increases conversion rates. For instance, Amazon uses real-time data to recommend products as users browse, driving higher sales.

- Advanced: Real-time customer interaction tracking (e.g., via WebSockets or APIs) allows businesses to respond instantly to customer needs, such as resolving issues via live chat or offering discounts to prevent cart abandonment. Machine learning models can analyze real-time clickstream data to predict customer preferences, boosting upsell and cross-sell opportunities.

- Profit Impact: Personalized experiences increase customer satisfaction, retention, and lifetime value, directly boosting revenue.

3. Optimized Operations and Cost Savings

- Basic: Real-time data helps businesses spot problems quickly, like a machine breaking down, so they can fix it before it costs more money.

- Intermediate: In supply chain management, real-time inventory tracking prevents stockouts or overstocking, reducing waste and storage costs. For example, Walmart uses real-time data to manage inventory across thousands of stores, ensuring products are available without excess stock.

- Advanced: IoT-enabled real-time monitoring of equipment (e.g., in manufacturing or logistics) enables predictive maintenance, reducing downtime by up to 30-50% (per McKinsey studies). Real-time supply chain analytics can optimize delivery routes, cutting fuel costs and improving efficiency.

- Profit Impact: Lower operational costs and higher efficiency translate to higher profit margins.

4. Real-Time Fraud Detection and Risk Mitigation

- Basic: Real-time data can catch suspicious activity, like a stolen credit card being used, stopping losses before they grow.

- Intermediate: Financial institutions use real-time transaction monitoring to detect anomalies, such as unusual spending patterns, and block fraudulent transactions instantly. For example, PayPal’s real-time fraud detection system analyzes billions of transactions to prevent losses.

- Advanced: Machine learning models process real-time data streams to score transactions for fraud risk, using features like location, device fingerprinting, and behavioral patterns. This minimizes chargebacks and protects revenue. In cybersecurity, real-time threat detection (e.g., via SIEM systems) prevents costly data breaches.

- Profit Impact: Preventing fraud and security losses preserves revenue and avoids reputational damage, which can cost millions.

5. Dynamic Marketing and Sales Opportunities

- Basic: Real-time data shows what customers are interested in right now, so businesses can send ads or offers at the perfect time.

- Intermediate: Real-time analytics on platforms like X or Google Ads allow businesses to adjust campaigns instantly based on performance metrics (e.g., click-through rates). For example, a retailer can shift ad spend to a trending product within hours.

- Advanced: Real-time bidding (RTB) in programmatic advertising uses live data to bid on ad impressions in milliseconds, ensuring ads reach the right audience at the optimal moment. Social media sentiment analysis in real time can also guide marketing strategies, such as responding to viral trends on X.

- Profit Impact: Targeted, timely marketing campaigns increase conversion rates and ROI, driving higher sales.

6. Improved Revenue Forecasting and Inventory Management

- Basic: Real-time data helps businesses know exactly what’s selling, so they don’t run out of popular items or order too much of something that’s not selling.

- Intermediate: Real-time sales tracking enables accurate demand forecasting, allowing businesses to adjust inventory levels dynamically. For example, Zara uses real-time sales data to restock trending fashion items within days.

- Advanced: Advanced analytics platforms integrate real-time data with predictive models to forecast demand with high accuracy, optimizing supply chains. For instance, machine learning models can analyze real-time point-of-sale data alongside external factors (e.g., weather, holidays) to predict sales spikes.

- Profit Impact: Avoiding stockouts and overstocking maximizes sales and minimizes waste, boosting profits.

7. Scalable Growth Through Automation

- Basic: Real-time data powers apps and systems that work automatically, like a website that updates prices without human help, saving time and money.

- Intermediate: Automation driven by real-time data, such as chatbots handling customer inquiries or automated trading systems, reduces labor costs and scales operations. For example, e-commerce platforms use real-time data to automate order processing and shipping updates.

- Advanced: Real-time data pipelines integrated with serverless architectures (e.g., AWS Lambda) enable scalable, automated workflows. For instance, real-time IoT data can trigger automated reordering when inventory levels drop below a threshold, streamlining operations.

- Profit Impact: Automation reduces operational costs and enables businesses to handle higher volumes, increasing profitability.

Practical Example: Real-Time Sales Dashboard

To illustrate how real-time data can drive profits, here’s a simple HTML and JavaScript-based dashboard using Chart.js to visualize live sales metrics, which a business could use to monitor performance and make quick decisions. This dashboard displays real-time sales data (e.g., total sales and transactions per minute), simulating how a company might track performance to optimize profits.

How It Helps Profits:

- This dashboard visualizes live sales and transaction data, allowing a business to spot trends (e.g., a sudden spike in sales) and act immediately, such as increasing ad spend or restocking inventory.

- For example, if transactions surge, the business could launch a real-time promotion to capitalize on the trend, driving higher revenue.

Real-Time Sales Dashboard

Live Data Feed Active

Advanced Insights for Maximizing Profits

- Integration with AI and Machine Learning:

- Real-time data feeds into AI models to predict customer behavior, optimize pricing, or detect anomalies, increasing profitability. For instance, Netflix uses real-time viewing data to recommend content, keeping users engaged and reducing churn.

- Profit Impact: Predictive analytics can increase conversions by 10-20% (per industry studies), directly boosting revenue.

- Scalability with Cloud and Edge Computing:

- Cloud platforms like AWS Kinesis or Azure Stream Analytics process massive real-time data streams, enabling businesses to scale operations without losing speed.

- Edge computing (e.g., processing IoT data on-site) reduces latency and costs, allowing real-time insights in remote locations.

- Profit Impact: Scalable systems support growth without proportional cost increases, improving margins.

- Real-Time Supply Chain Optimization:

- Companies like Amazon use real-time data to optimize logistics, such as rerouting deliveries based on live traffic data, reducing costs by 10-15% (per logistics studies).

- Profit Impact: Efficient supply chains lower costs and improve customer satisfaction, driving repeat purchases.

- Monetizing Real-Time Data:

- Businesses can sell real-time data or insights to partners. For example, financial firms sell real-time market data to traders, creating new revenue streams.

- Profit Impact: Data monetization opens additional income sources, directly increasing profits.

Challenges to Consider

While real-time data drives profits, it comes with challenges:

- Cost: Real-time systems require investment in infrastructure (e.g., cloud services, high-speed networks).

- Complexity: Building and maintaining real-time pipelines demands expertise in streaming technologies and data engineering.

- Data Quality: Ensuring accuracy in fast-moving data is critical to avoid costly mistakes (e.g., acting on erroneous sales data).

Real-World Example from X

On the X platform, businesses can use real-time data to track trending topics or user engagement instantly. For instance, a brand could monitor real-time mentions of its product, launching a targeted ad campaign within minutes to capitalize on a viral moment, driving sales. If you’d like, I can search X for specific examples of businesses using real-time data for profit.

Faster Decisions: The market can change suddenly—a big news event or a price crash can happen anytime. With real-time data, you can react instantly. For example, if a company’s shares surge after a major deal, you can buy immediately and lock in profits.

- Reducing Risk: Analytics warns you about risky stocks. If a stock looks unstable, you can avoid it and keep your money safe.

- Optimizing Your Portfolio: You have 5-6 stocks, but which ones are performing? Real-time analytics tells you, allowing you to adjust your investments for maximum profit.

- Staying One Step Ahead: Those who use real-time data stay ahead of other traders. This competitive edge can skyrocket your profits.

Real Example: A day trader checks real-time data at 9 AM and notices a stock’s price is low but its trading volume is rising. He buys it, and by 3 PM, the price jumps 20%. He sells and secures a solid profit in a single day.

Top Tools to Take Your Trading to the Next Level

Real-time data analytics relies heavily on tools. Let’s look at some top tools that can help you:

- TradingView: An amazing platform where you can view real-time charts, apply technical indicators, and interact with other traders. Perfect for both beginners and pros.

- Bloomberg Terminal: A favorite among professional traders, it offers detailed data, analytics, and news. However, it’s costly, with monthly subscriptions in the thousands.

- Yahoo Finance: A great free option providing real-time quotes, basic analytics, and the latest news—all for free!

- MetaTrader: Popular for forex and stock trading, it offers real-time data and automated trading options, loved by advanced traders.

How to Use Them? Each tool has its own style. TradingView is beginner-friendly, while Bloomberg is for serious players. Choose based on your budget and needs, and get started!

The Truth: Real-Life Success Stories

Let’s draw some inspiration from real-life examples that show how real-time data analytics works:

Case Study 1: High-Frequency Trading (HFT)

HFT firms use real-time data to execute thousands of trades per second. They analyze microsecond-level data and make small profits per trade. Their high volume leads to crores in daily profits.

Case Study 2: A Common Trader’s Story

Manoj, an ordinary investor, used to trade based on friends’ tips. When he started using real-time data and TradingView, his strategy changed. He noticed a breakout pattern in a stock and bought it based on real-time data. Within a week, he made a 30% profit—proof of real-time data’s power!

These examples show that whether you’re a big player or a small trader, real-time data can work for you.

How You Can Become a Successful Trader: Step-by-Step Guide

So, how do you start? Here’s a simple guide:

Step 1: Choose a Platform

Select a platform that offers real-time data. Beginners should try TradingView or Yahoo Finance.

Step 2: Learn the Basics

Understand technical analysis (charts, trends) and fundamental analysis (company research). Start with YouTube or free courses.

Step 3: Practice

Try a demo account or paper trading to learn without risking money.

Step 4: Start with Small Investments

Once confident, begin trading with small amounts. Scale up as you gain experience.

Step 5: Stay Updated

The market is always changing, so keep learning new trends and strategies.

Follow this guide, and you can boost your profits with real-time data!

Frequently Asked Questions (FAQs)

- How much money is needed for real-time data analytics?

Some tools are free (like Yahoo Finance), but premium tools like Bloomberg have monthly fees ranging from ₹20,000 to lakhs. - Can beginners use it?

Yes, by learning the basics and starting with simple tools, beginners can benefit. - Which tools are free?

Yahoo Finance, Google Finance, and TradingView’s basic version are free. - How accurate is real-time data?

It’s usually accurate since it comes directly from exchanges, but technical glitches can occur. - Does it guarantee profits?

No, the market always involves risk. These tools help make better decisions but don’t guarantee profits.

Conclusion: A New Beginning

Real-time stock data analytics is a tool that helps you keep pace with every market move. It’s a combination of speed, accuracy, and smart decisions that can skyrocket your profits. If you want to take your trading to the next level, start now—choose the right platform, learn, and practice. Remember, in the stock market, knowledge and timing are everything. So why wait? Begin your journey today and watch your profits soar!

Happy trading, and don’t forget to share your success stories with us!

Note: If you’d like a chart to visualize how real-time data impacts stock price movements (e.g., a stock’s breakout pattern), I can create one—just confirm if you want it. Also, let me know if you need help with specific tools or setting up a trading strategy!