How to earn by helping people fill online forms in India in 2025

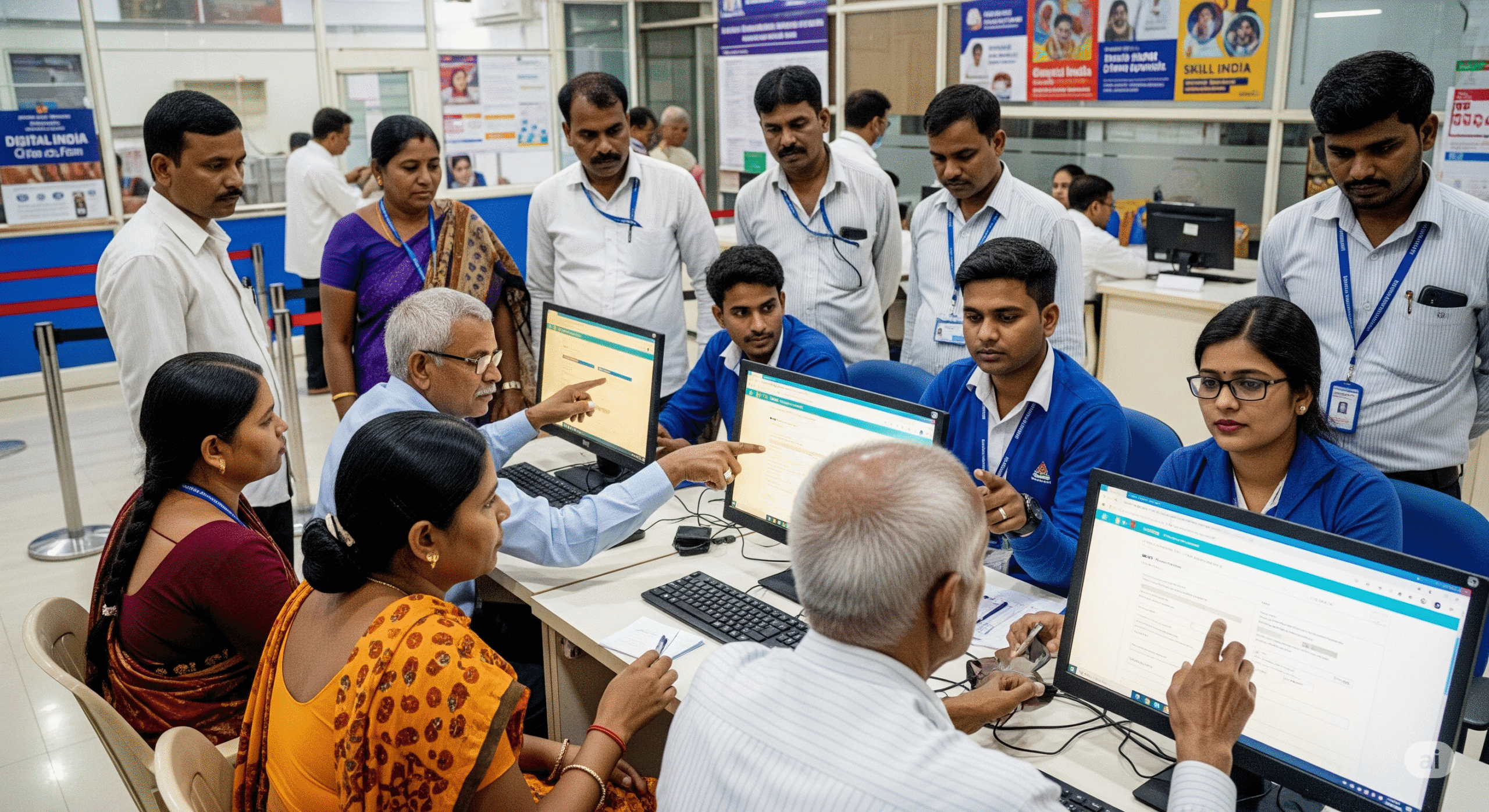

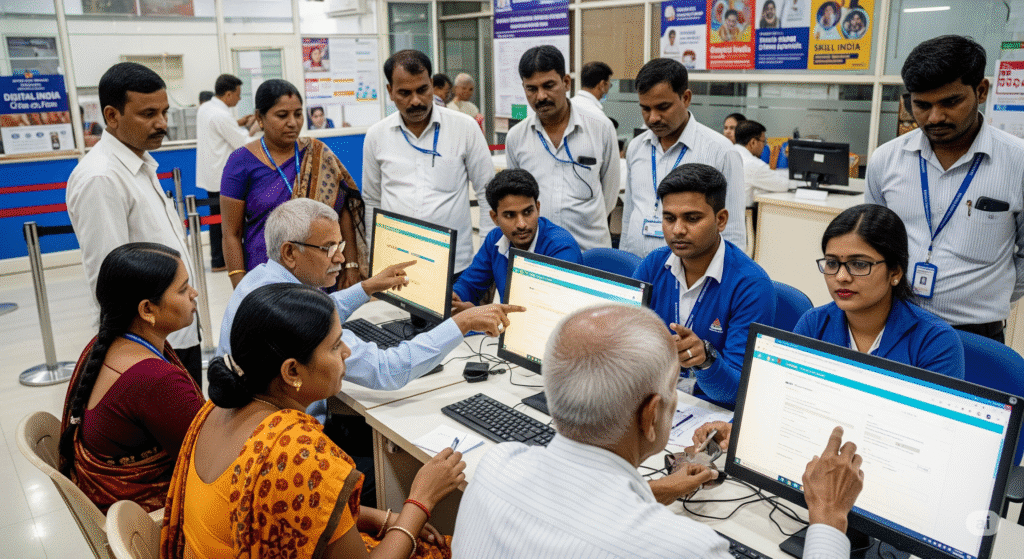

Hey there, reader! Imagine this: Mr. Sharma, a hardworking tailor in a small town, needs to renew his shop’s license. He hears it’s all online now – “Digital India!” they say. He logs in, stares at the portal, and feels a wave of panic. The form has 15 sections, jargon he doesn’t understand, fields demanding documents he’s unsure about, and cryptic error messages. Hours turn into days. Frustration mounts. His business is on hold.

Now, imagine you stepping in. With calm expertise, you guide him, clarify the requirements, help gather documents, fill the form accurately, submit it, and track it until the shiny new license arrives. Mr. Sharma is overjoyed, his business runs smoothly again, and he gladly pays you for saving him time, stress, and potential penalties.

This, my friend, is not just a feel-good story. It’s the core of a massive, recession-proof, and deeply rewarding income opportunity blooming across India right now. Helping people navigate the labyrinth of online government forms isn’t just a service; it’s solving a critical pain point in a nation racing towards digital governance.

The scale is staggering. From PAN cards and Aadhaar updates to GST registration, pension claims, scholarship applications, and land records – hundreds of millions of interactions with government services are moving online annually. Yet, a significant portion of India’s population – the elderly, those in rural areas, people with limited digital literacy, non-English speakers, or simply busy citizens – finds this transition daunting, confusing, and time-consuming.

That gap between complex digital systems and the people who need to use them is your golden ticket. This comprehensive guide is your blueprint to building a sustainable, ethical, and profitable business or side hustle by becoming a trusted guide in the world of online government forms in India.

Why This Opportunity is Exploding (And Why NOW is the Time):

- Government Push: “Digital India” isn’t a slogan; it’s a relentless drive. Ministries and departments are mandated to move services online (e-Governance). Portals like UMANG, State Seva Kendras, PFMS, e-District, and countless department-specific sites are proliferating.

- Massive User Base: India has over 880 million internet users. Even if 10% struggle with government portals, that’s 88 million potential clients. The demand is real and growing daily.

- Complexity & Fragmentation: Each department has its own portal, rules, forms, and processes. Keeping track is a full-time job. Aadhaar linking alone created years of demand.

- Digital Divide Persists: While connectivity improves, digital skills and comfort lag behind, especially outside major metros and among older demographics. Language barriers (many portals are primarily English) compound the issue.

- High Stakes: Mistakes on government forms can lead to delays, rejections, financial losses (fines, missed benefits), legal hassles, and immense stress. People value accuracy and peace of mind.

- Low Entry Barrier: You don’t need a fancy degree (though knowledge is key). You need a computer, internet, patience, meticulousness, and a willingness to learn.

This guide will walk you through EVERYTHING you need to know:

- Understanding the Landscape & Your Value Proposition: The problems you solve and why people will pay.

- Essential Skills & Knowledge Base: What you must know (and how to learn it).

- Core Services You Can Offer: The most popular and profitable form-filling categories.

- Setting Up Your Business: Legalities, structure, pricing models, and tools.

- Finding Your Clients: Proven marketing strategies (online & offline).

- Delivering Exceptional Service: The step-by-step client process, ensuring accuracy and security.

- Scaling Your Income: Moving beyond one-on-one help.

- Ethics, Pitfalls & Staying Safe: Navigating the crucial dos and don’ts.

- The Future & Your Role: Where is this heading, and how can you stay ahead?

Buckle up. Let’s transform confusion into your career.

Part 1: The Lay of the Land – Understanding the Need & Your Niche

1.1 The Tangible Pain Points You Solve

Why do people desperately need help? Let’s break down the common frustrations:

- Information Overload & Confusion: “Which portal? Which form? What documents? What do these terms mean?” Navigating multiple government websites (often poorly designed) is overwhelming.

- Technical Glitches & Poor UX: Portals crash, sessions timeout, uploads fail, error messages are unhelpful. What seems simple to you can be a brick wall for others.

- Language Barriers: While Hindi options exist, many critical portals and forms are predominantly in English, excluding a vast population.

- Documentation Nightmares: Understanding precisely which documents are needed, in what format (scanned size, PDF vs JPG), and ensuring they are correct and up-to-date is a major hurdle.

- Fear of Mistakes: “What if I put the wrong income? What if I select the wrong category? Will I get fined? Will my application be rejected?” The consequences of errors feel severe and paralyzing.

- Time Sink: What might take you 30 minutes could take an inexperienced person days of trial, error, and research – time they often don’t have.

- Lack of Trust in Local Touts: While physical “form-fillers” exist (especially near government offices), many operate unethically, overcharge, or provide unreliable service. You offer a professional, transparent alternative.

- Follow-up Fatigue: Submitting the form is often just step one. Tracking application status, responding to queries or deficiencies, and understanding next steps add more layers of complexity.

Your Value Proposition is Crystal Clear: You eliminate these pain points. You provide Clarity, Accuracy, Speed, Convenience, and Peace of Mind. Clients pay not just for your time, but for the relief and the assurance that things will be done right.

1.2 Who Are Your Potential Clients? (Target Audience Deep Dive)

Your services aren’t for everyone, but the market is vast and diverse:

- Small Business Owners & Entrepreneurs: The GST regime alone is a goldmine. Think:

- New registrations (GST, Udyam/MSME, Shop & Establishment, FSSAI).

- Monthly/Quarterly/Annual Returns (GSTR filings).

- Invoicing compliance.

- EPFO/ESI registrations and filings.

- Trademark registration.

- Example: Priya runs a small bakery. She needs GST registration, FSSAI license, and Udyam registration. She’s great at baking but terrified of portals and tax jargon.

- Senior Citizens: Often less tech-savvy and needing help with:

- Pension schemes (central/state govt, EPS).

- Life certificates (Jeevan Pramaan).

- Aadhaar updates (address, mobile, biometric).

- Income Tax Returns (especially for pension income).

- CGHS claims and beneficiary registrations.

- Example: Mr. Joshi, 72, needs to submit his annual Jeevan Pramaan online. His fingerprint scanner isn’t working, and he can’t navigate the website.

- Students & Parents:

- Scholarship applications (National/State level – NSP, PFMS portals).

- University admissions forms (often linked to government portals).

- Educational loan applications.

- Aadhaar seeding with bank accounts and educational records.

- Example: Ravi’s daughter is applying for a Post-Matric Scholarship. The form is complex, requires income certificates, caste certificates, and bank details to be linked correctly on the NSP portal.

- Job Seekers & Professionals:

- PAN card applications/updates.

- Aadhaar updates.

- EPF withdrawals/transfers.

- Professional tax registration (state-specific).

- Example: Ankit changed jobs and needs to transfer his EPF from his old company to the new one. The online process confuses him.

- Farmers & Rural Population:

- PM Kisan Samman Nidhi registration and status checks.

- Crop insurance schemes (PMFBY).

- Land record applications (mutations, copies – via state Bhulekh/ILRMS portals).

- Subsidy applications (seeds, equipment).

- Example: Suresh, a farmer, wants to apply for the PM Kisan scheme but doesn’t know how to access the portal or upload his land documents.

- Property Owners & Buyers:

- Checking Encumbrance Certificates (EC).

- Applying for property tax payments online.

- Mutation of land records.

- RERA-related registrations and complaints.

- Example: The Mehtas bought a flat and need to get the mutation done online to reflect their ownership in government records.

- General Citizens:

- Passport applications and renewals.

- Driving License applications, renewals, duplicates.

- Voter ID applications and corrections (NVSP).

- Ration card applications and updates.

- Income Tax Returns (ITR) filing for salaried individuals (ITR-1/2).

- Aadhaar services.

- Example: Mrs. Kapoor needs to renew her passport. The online form asks for detailed travel history and references. She finds it intimidating.

Key Insight: Your ideal client is someone who values their time and peace of mind more than the fee you charge. They recognize that the cost of a mistake (rejection, delay, fine) far outweighs your service charge.

1.3 The Competitive Landscape: Who Else is Playing?

You won’t be alone, but understanding the competition helps you differentiate:

- Physical “Form-Fillers” / Touts: Often found near government offices. Pros: Local presence, handle physical submissions. Cons: Often lack transparency, can be expensive, quality unreliable, may engage in unethical practices. Your Edge: Professionalism, transparency, remote service, better accuracy, ethical approach.

- Large Franchisee Networks (e.g., CSC VLEs): Common Service Centers (CSCs) are government-authorized kiosks offering digital services, often run by Village Level Entrepreneurs (VLEs). Pros: Authorized, wide range of services, physical presence. Cons: Can be busy, service quality varies, may focus on volume. Your Edge: Personalized attention, potentially deeper expertise in specific areas, flexibility (remote service), potentially faster turnaround for specific tasks.

- CA/CS/Advocate Firms: Offer form filling as part of broader compliance or legal services. Pros: High expertise. Cons: Very expensive (overkill for simple forms), may not take on small individual tasks. Your Edge: Affordability for standard form filling, focus solely on this niche.

- Online Freelancers (e.g., on Fiverr/Upwork): Individuals offering similar services online. Pros: Easy to find. Cons: Quality and reliability can be hit-or-miss, security concerns sharing sensitive docs. Your Edge: Build direct trust, local market focus, potentially better understanding of regional nuances.

- DIY Citizens: Those who struggle through it themselves. Your Edge: You save them the immense hassle, time, and risk of errors.

Your Winning Position: Position yourself as the trusted, tech-savvy, patient, and meticulous personal guide. Offer a blend of expertise, convenience (remote), transparency in pricing, and a strong ethical compass, especially regarding data privacy. Specialization (e.g., becoming the “GST filing expert” or “Pension application specialist” in your area) can be a powerful differentiator.

Part 2: Equipping Yourself for Success – Skills, Knowledge & Tools

You can’t build a house without tools and skills. This business requires a specific toolkit.

2.1 Foundational Skills: The Non-Negotiables

- Digital Literacy (Advanced User Level):

- Proficiency with web browsers, online forms, portals.

- Understanding file formats (PDF, JPG, PNG), compression, scanning basics.

- Ability to troubleshoot common tech issues (browser settings, clearing cache, basic connectivity).

- Comfort with digital communication tools (email, WhatsApp, video calls).

- Research Prowess: Government portals change. Rules get updated. Your ability to:

- Find the correct official website for any service.

- Locate and understand the latest instructions, circulars, and FAQs.

- Verify information from reliable sources (govt portals, official notifications).

- Attention to Detail (Extreme Meticulousness): This is paramount. A single digit wrong in a PAN, Aadhaar, or bank account number can derail an entire application. Double and triple-checking everything is your mantra.

- Patience & Empathy: Clients are often stressed and confused. You need the patience to explain things simply (multiple times if needed), listen to their concerns, and reassure them without judgment. Remember Mr. Sharma’s panic?

- Communication Skills (Clear & Simple):

- Verbal: Explaining complex steps in easy-to-understand language. Avoid jargon. Use analogies (“Think of your PAN like a social security number for taxes”).

- Written: Clear emails, WhatsApp messages, and instructions. Good grammar and spelling build professionalism.

- Active Listening: Understand the client’s actual need, not just what they initially say.

- Organizational Skills: Juggling multiple clients, deadlines (e.g., GST due dates), and document sets requires excellent organization. You can’t lose Mr. Joshi’s pension documents!

- Basic Problem Solving: Forms throw errors. Portals glitch. Documents get rejected. You need the calm persistence to figure out why and find a solution. Googling error codes effectively is a key skill!

- Ethics & Integrity: Handling sensitive personal data (Aadhaar, PAN, bank details, property papers) demands absolute integrity. Client confidentiality is sacred. Never promise what you can’t deliver.

2.2 Core Knowledge Areas: Your Expertise Domain

This is where you become the expert. Focus on breadth initially, then deepen in high-demand areas.

- Identity & Key Documents: Deep understanding of:

- Aadhaar: Enrollment, updates (demographic, biometric), linking, mAadhaar app, status checks. Know the UIDAI portal inside out.

- PAN: Application (Form 49A/49AA), linking with Aadhaar, corrections, status. Master the NSDL and UTIITSL portals.

- Voter ID (EPIC): Application, corrections, transposition, deletion via NVSP portal.

- Driving License (DL) & Vehicle Registration (RC): State-specific RTO portals for applications, renewals, duplicates, address changes, international permits.

- Taxation (Basic to Intermediate):

- Income Tax Returns (ITR): Primarily ITR-1 (Sahaj) and ITR-2 for salaried individuals and those with house property/other basic income. Understand Form 16, deductions (80C, 80D, HRA, etc.), e-filing process on the Income Tax e-Filing portal. *Crucially: Know your limits. Complex capital gains or business income (ITR-3/4) often require a CA. Stick to straightforward cases.*

- GST (Goods and Services Tax): This is a massive area. Focus on:

- New Registration (GST REG-01).

- Basic understanding of returns: GSTR-1 (Outward Supplies), GSTR-3B (Summary Return), GSTR-4 (Composition Scheme).

- Invoicing rules (basic structure).

- Amendments, cancellations.

- Navigating the GSTN portal. Specializing here is highly lucrative.

- TDS (Tax Deducted at Source): Form 26AS understanding, basic TRACES portal navigation for certificates. Primarily needed for ITR support.

- Social Security & Pensions:

- Employees’ Provident Fund (EPFO): UAN activation, passbook, KYC updates (Aadhaar, PAN, bank), withdrawals (Form 19, 10C, 31), transfers (Form 13), pension claims. Mastering the EPFO Unified Portal is essential.

- National Pension System (NPS): Account opening (for individuals), contributions, withdrawals. Know the CRA (Central Recordkeeping Agency) portals (NSDL, KFintech).

- Jeevan Pramaan (Digital Life Certificate): Process for pensioners.

- PM Shram Yogi Maan-dhan (PM-SYM), National Pension Scheme for Traders and Self-Employed Persons (NPS-Traders): Enrollment processes.

- Business Registrations & Compliance:

- Udyam Registration (MSME): The simplified process replacing EM-I/II.

- Shop & Establishment Act Registration: State-specific portals.

- Professional Tax Registration: State-specific.

- FSSAI Registration/License: Basic food license applications.

- Central & State Government Schemes:

- PM Kisan Samman Nidhi: Registration, status check, e-KYC.

- Scholarships: National Scholarship Portal (NSP), PFMS portals for various schemes.

- Ration Card: Application, addition/deletion of members, state-specific portals.

- Pradhan Mantri Awas Yojana (PMAY): Application processes (rural/urban).

- State-specific Schemes: Be aware of key schemes in your operational states (e.g., farmer subsidies, health schemes).

- Property & Land Records:

- Accessing state Bhulekh/ILRMS portals for land records (Khatauni, Khasra).

- Applying for Encumbrance Certificates (EC).

- Online Property Tax Payments (municipal corporation portals).

- Mutation applications (online via state portals where available).

- Passport & Visa Services: Detailed knowledge of the Passport Seva Online (PSK) portal for fresh applications, renewals, police clearance certificates (PCC). Visa application support is more complex and often requires specialized agents.

- Other High-Demand Areas:

- Vehicle-related: Transfer of Ownership, hypothecation removal.

- Education: University admission forms (often govt affiliated).

- Legal: Basic e-Courts portal navigation for case status (not legal advice!).

How to Acquire & Continuously Update Knowledge:

- Official Portals are Your Bible: Spend hours exploring the major portals (UMANG, e-Filing, GSTN, EPFO, UIDAI, Passport Seva, your state’s e-District/Seva Kendra portal). Read every FAQ, instruction manual, and circular you can find.

- Government Announcements: Follow official social media handles (Twitter, Facebook) of key ministries (Finance, Electronics & IT, Labour, Home Affairs) and departments.

- Reputable News & Info Sites: Websites like ClearTax, Taxmann, BankBazaar, and government-focused news sections of major dailies often provide simplified explanations and updates.

- YouTube Tutorials: Search for “[Service Name] online process 2024”. Watch multiple videos to get different perspectives. Always verify with official sources.

- Practice on Dummy Data: Many portals have demo modes or allow you to start applications without submitting. Use these to practice.

- Join Online Forums & Communities: Platforms like Reddit (r/IndiaTax, r/LegalAdviceIndia – carefully), specialized Facebook groups, or Quora can offer insights into common problems and solutions (but verify!).

- Continuous Learning: Dedicate time weekly to check for updates on your core service areas. Rules change frequently!

2.3 Essential Tools & Setup

You don’t need a fortune to start:

- Hardware:

- Reliable Computer/Laptop: Your primary workstation.

- Smartphone: Essential for OTPs, client communication (WhatsApp), scanning apps.

- High-Speed Internet Connection: Non-negotiable. A backup (mobile hotspot) is wise.

- Scanner (or Smartphone Scanning App): CamScanner, Adobe Scan, or built-in Notes apps work well for document capture. Ensure good quality.

- Printer (Optional but Recommended): For generating client checklists, receipts, or occasionally printing forms that require wet signatures (though this is decreasing).

- Webcam & Microphone: For client consultations via video call (Zoom, Google Meet, WhatsApp video).

- Software & Online Tools:

- Secure Cloud Storage: Mandatory. Google Drive, Dropbox, or OneDrive with strong passwords and 2FA to store client documents securely and encrypted. Never store sensitive data solely on your local machine.

- Password Manager: (e.g., Bitwarden, LastPass) To securely manage your numerous government portal logins (though you generally won’t log in as the client! See Ethics section).

- Document Editing: PDF editing software (Adobe Acrobat Reader DC is free for basic viewing, paid for editing) or online tools like ILovePDF/Smallpdf for merging, splitting, compressing.

- Communication: Professional Email Address (yourbusinessname@gmail.com is fine initially), WhatsApp Business App (highly recommended for Indian clients).

- Accounting & Invoicing: Start simple with Excel/Google Sheets. Upgrade to free/low-cost tools like Zoho Invoice or Wave as you grow.

- Calendar/Scheduler: Google Calendar for managing appointments and deadlines.

- Security Setup (PARAMOUNT):

- Antivirus & Firewall: Keep them active and updated.

- Operating System Updates: Always install the latest security patches.

- Two-Factor Authentication (2FA): Enable on EVERY account possible (email, cloud storage, banking).

- Strong, Unique Passwords: For every login. Use the password manager.

- Data Encryption: Ensure your cloud storage encrypts data at rest and in transit. Consider encrypting sensitive files locally before upload.

- Client Consent Forms: Develop a simple form outlining the services, fees, and how their data will be used/stored/secured/destroyed (see Legal/Ethics section).

Your Workspace: Create a dedicated, quiet space for work. Professionalism starts at home.

Read more:

Part 3: Your Service Menu – What Exactly Can You Offer (Profitably)?

This is where you translate knowledge into revenue. Let’s break down the major categories, their processes, earning potential, and considerations.

3.1 The Bread & Butter: Identity & Essential Documents

High volume, relatively straightforward, constant demand.

- Aadhaar Services:

- Updates (Major & Minor): Demographics (Name, Address, DoB, Gender, Mobile, Email), Biometrics (Fingerprints, Iris, Photo). Process: Client provides proof docs (scans). You fill online form, book appointment (if biometric update needed), guide them through visit or confirm postal update. Fee: ₹150-₹500 depending on update type and complexity. Key: Understanding valid Proof of Identity (PoI) and Proof of Address (PoA) documents. UIDAI portal mastery.

- Linking/Status Check: Help link Aadhaar with PAN, Bank, Mobile, Ration Card, etc., and check status. Fee: ₹50-₹200. Often bundled with other services.

- Enrollment Support: Guiding new applicants (rare now, but needed). Fee: ₹200-₹500. Caution: Enrollment must be done physically at authorized centers; you can only assist with form pre-fill and document prep.

- PAN Card Services:

- New Application (Form 49A/49AA): Process: Gather client details, select appropriate category, fill form online (NSDL/UTIITSL), help with payment, arrange courier of signed form/photos if required (physical signature often needed). Fee: ₹300-₹800 (including govt fees). Key: Accuracy in name, father’s name, DoB matching ID proofs.

- Corrections/Updates/Reprint: Process: Similar to new application, using correction form. Fee: ₹200-₹600. Key: Understanding acceptable proof for changes.

- Linking with Aadhaar: Process: Via e-Filing portal or SMS. Fee: Often bundled (₹50-₹150).

- Voter ID Services (NVSP Portal):

- New Application (Form 6): Process: Fill form, upload docs (address, age, photo). Fee: ₹250-₹600.

- Shifting Constituency (Form 6/8A): Fee: ₹300-₹700.

- Corrections (Form 8): Name, photo, age, EPIC number. Fee: ₹200-₹500.

- Deletion (Form 7): Fee: ₹200-₹500.

- Driving License & RC Services (State RTO Portals – e.g., Sarathi/Parivahan):

- Learner’s License (LL) Application: Process: Form fill, slot booking for test. Fee: ₹300-₹700.

- Permanent License (DL) Application: After LL. Fee: ₹400-₹800.

- Renewal of DL/RC: Process: Form fill, payment, document upload. Fee: ₹300-₹700.

- Duplicate DL/RC: Fee: ₹300-₹700.

- Address Change: Fee: ₹300-₹600.

- International Driving Permit (IDP): Fee: ₹500-₹1000. Key: Deep knowledge of your state’s specific portal and processes is crucial.

- Passport Services (Passport Seva):

- Fresh Application/Renewal: Process: Filling detailed online form, document checklist guidance, appointment booking support, post-submission tracking. Fee: ₹800-₹2000+ depending on complexity (tatkal, normal, police verification follow-up). Key: Accuracy is critical; mistakes cause significant delays. Understanding police verification process helps manage client expectations.

- Police Clearance Certificate (PCC): Fee: ₹500-₹1500.

Profitability: High volume potential, lower individual fees but faster turnaround. Essential for building a client base. Often the “gateway” service that leads to more complex work.

3.2 The Goldmine: Taxation & GST Compliance

Higher complexity, recurring revenue, higher fees. Requires continuous learning.

- Income Tax Return (ITR) Filing (Basic – ITR-1/2):

- Process: Gather Form 16, investment proofs (80C, 80D, etc.), bank interest statements, home loan details (if applicable). Pre-fill data validation. Fill appropriate ITR form on e-Filing portal. Calculate tax liability/refund. E-verify return. Fee: ₹500 – ₹2500+ depending on income sources, deductions, and complexity. Crucial: Know Your Limits. Only handle straightforward salaried income, one house property, other basic income. Refer ITR-3 (Business) or ITR-4 (Presumptive) to CAs. Always have the client review and approve before submission. Emphasize you are a filing service, not a tax advisor giving planning advice.

- Corrections (Revised Return): Fee: ₹300-₹1000.

- GST Services (GSTN Portal – Requires significant expertise):

- New Registration (GST REG-01): Process: Detailed form filling, business description, principal place, bank details, promoter details, documents upload (PAN, Aadhaar, proof of business, bank statement, photos, authorization letter). ARN tracking, follow-up for deficiencies. Fee: ₹1500 – ₹5000+ (high value due to complexity and risk). Key: Understanding business constitution (Proprietor, Partnership, LLP, Company), HSN/SAC codes, state-specific requirements.

- GSTR Filings (Ongoing Compliance): The recurring revenue stream.

- GSTR-1 (Outward Supplies – Sales): Monthly/Quarterly. Fee: ₹500 – ₹2000 per filing. Complexity depends on number of invoices.

- GSTR-3B (Summary Return): Monthly. Fee: ₹800 – ₹3000 per filing. Requires reconciling sales (GSTR-1), purchases (GSTR-2B), tax liability calculation.

- GSTR-4 (Composition Scheme): Quarterly. Fee: ₹500 – ₹1500 per filing. Simpler but specific rules.

- Annual Return (GSTR-9/9A/9C): Fee: ₹2000 – ₹10,000+ (high complexity, reconciliation).

- Amendments & Cancellations: Fee: ₹1000 – ₹4000.

- LUT (Letter of Undertaking) for Exports: Fee: ₹500-₹1500.

- TDS Related Support (Primarily for ITR):

- Form 26AS Reconciliation: Helping clients understand their TDS credits. Fee: Often bundled with ITR (₹200-₹500 standalone).

- Downloading Form 16A/16B from TRACES: Fee: Minimal, often bundled.

Profitability: High. GST registrations and filings are the core income drivers for specialists. Recurring filings provide stable monthly revenue. Requires significant upfront learning and ongoing updates. Accuracy is critical to avoid client penalties.

3.3 Social Security & Pensions: Building Trust for Long-Term Needs

Often involves vulnerable populations (seniors), requiring extra patience and empathy. High trust factor.

- EPFO Services (Unified Portal):

- UAN Activation & KYC Update: Process: Guiding client through activation, linking Aadhaar, PAN, bank details, updating mobile/email. Fee: ₹200-₹500.

- Passbook & Claim Status Check: Fee: Often bundled or minimal (₹50-₹200).

- Withdrawals (Form 19/10C/31): Process: Detailed form filling, KYC validation, digital signature (Aadhaar-based or physical if required), coordination with employer for approval (if needed). Fee: ₹800-₹2500+ per claim. Key: Understanding eligibility (service period, reasons for withdrawal), ensuring bank details are perfect.

- Transfer (Form 13): Moving PF from old employer to new. Fee: ₹1000-₹3000. Can be complex if previous employers are unresponsive.

- Pension Claims (Form 10D): Process: Complex form, extensive documentation (service proof, age proof, discharge proof, bank details, spouse nomination). Fee: ₹1500-₹5000+. Requires meticulousness.

- NPS (Individual – Tier I/Tier II):

- Account Opening (Subscriber Registration): Process: Form filling (NSDL/KFintech portal), document upload, payment initiation. Fee: ₹500-₹1500.

- Contribution Processing: Fee: ₹100-₹300 per transaction (can be bundled).

- Withdrawal (Exit): Process: Complex forms (60/61), documentation, choosing annuity provider. Fee: ₹1500-₹4000. Key: Understanding withdrawal rules (exit age, % lumpsum vs annuity).

- Jeevan Pramaan (Digital Life Certificate): Process: Guiding pensioner through app setup or biometric device use. Fee: ₹200-₹500. Often a goodwill service for existing pensioner clients.

- Government Pension Scheme Enrollment (PM-SYM, NPS-Traders): Process: Form filling, document upload, payment setup. Fee: ₹300-₹800.

Profitability: Moderate to High per transaction. Withdrawals and pension claims are complex and valued. Builds deep client loyalty. Requires understanding complex rules and compassionate communication.

3.4 Business Registrations & Compliance: Empowering Entrepreneurs

Serving the small business ecosystem is rewarding and lucrative.

- Udyam Registration (MSME): Process: Simple online form based on PAN and GSTN (if applicable). Fee: ₹500-₹1500. High volume potential for new businesses.

- Shop & Establishment Registration: Process: State-specific online portals. Form filling, document upload. Fee: ₹1000-₹3000.

- FSSAI License/Registration: Process: Determining license type (Basic/State/Central), form filling (FOSCOS portal), document upload. Fee: ₹1500-₹4000.

- Professional Tax Registration (State-Specific): Process: State labour/PT department portal. Fee: ₹800-₹2000.

- Trademark Registration (Basic – Class 1): Process: TM-A form fill on IP India portal, trademark search guidance, document preparation. Fee: ₹2500 – ₹8000+. Key: Basic understanding of trademark classes; complex cases need attorneys. Manage expectations.

Profitability: Good fees for registrations. Can lead to ongoing compliance work (like GST, PT returns). Udyam is a high-volume entry point.

3.5 Government Schemes & Benefits: Connecting People to Welfare

Social impact alongside income. Requires awareness of diverse schemes.

- PM Kisan Samman Nidhi: Process: New registration, status check, e-KYC update, correction support. Fee: ₹200-₹600 per service.

- Scholarships (NSP/PFMS): Process: Complex form filling, document gathering (income, caste, marksheets, bank details), application tracking. Fee: ₹300-₹1000 per application. Key: Meeting deadlines is critical.

- Ration Card Services (State Portals): Process: New application, addition/deletion of members, updates. Fee: ₹250-₹700.

- PMAY (Urban/Rural): Process: Form filling, document upload, application tracking. Fee: ₹1000-₹3000. Key: Eligibility criteria are strict; manage client expectations.

- State-Specific Schemes: Identify 2-3 high-demand schemes in your area (e.g., farmer subsidies, health cards, widow pensions). Learn their portals and processes. Fee: Varies widely.

Profitability: Variable, often moderate fees. Volume can be high during application windows. Strong social value proposition.

3.6 Property & Land Records: High Stakes, High Value

Requires precision and understanding of local land terms.

- Land Record Access (Bhulekh/ILRMS): Process: Helping clients navigate state portals to view Khatauni, Khasra, plot details. Fee: ₹200-₹500 per search. Key: Not interpretation, just access.

- Encumbrance Certificate (EC) Application: Process: Online application via state portal, payment, download. Fee: ₹300-₹800.

- Online Property Tax Payment: Process: Guiding payment on municipal corporation portal. Fee: ₹100-₹300 (often bundled).

- Mutation Application (Where Online): Process: Complex form filling, document upload (sale deed, ID proofs, NOC). Fee: ₹1500-₹5000+. Key: Critical process; mistakes can cause major issues. Requires deep understanding of local requirements and documents.

Profitability: EC and Mutation commands higher fees due to importance and complexity. Requires specialized knowledge of local land records systems.

3.7 Bundling Services & Packages

Increase your average transaction value:

- “New Business Starter Pack”: Udyam + GST Registration + Shop & Establishment + Basic Current Account guidance (referral).

- “Senior Citizen Support”: Jeevan Pramaan + Pensioner ITR + Aadhaar Update + CGHS beneficiary registration support.

- “Passport Complete”: Form filling + document checklist + appointment booking + tracking + PCC application if needed.

- “Annual Compliance Pack” (Small Business): GST Returns (12 GSTR-3B + 4 GSTR-1) + PT Return + Basic ITR filing for proprietor. Offer a discounted bundle.

Pricing Strategy Deep Dive: How much should you charge?

- Cost-Plus: Calculate your time cost (e.g., ₹500/hour) + overheads + small profit margin. Estimate time for each service.

- Value-Based: What is the value to the client? Saving hours of frustration? Avoiding a ₹5000 GST penalty? Getting a ₹50,000 scholarship? A passport enabling a job abroad? Price accordingly.

- Competition-Based: Research what local touts, CSCs, and online freelancers charge. Aim for a premium justified by your professionalism and accuracy.

- Tiered Pricing: Basic (form fill only), Standard (form + doc checklist), Premium (form + doc prep + submission + tracking).

- Factors Influencing Price:

- Complexity of the form/process.

- Time estimated.

- Risk/Stakes involved (higher stakes = higher fee).

- Your expertise level in that area.

- Client location (urban might bear higher fees than rural).

- Recurring vs. one-off.

- Volume discounts.

- Transparency is Key: Clearly state your fees upfront, preferably in writing (brochure, WhatsApp message). Avoid hidden charges. Distinguish your service fee from government fees (which the client usually pays directly).

Part 4: Building Your Business – Setup, Operations & Marketing

You have the skills and know what to sell. Now, let’s build the machine.

4.1 Choosing Your Business Structure & Legalities

Start simple, formalize as you grow.

- Starting as an Individual (Sole Proprietor):

- Pros: Simplest, lowest cost. Just open a separate bank account. Register on Udyam as an Individual Service Provider (Code 99969).

- Cons: Unlimited personal liability. Harder to build trust/brand. Limited scalability.

- Compliance: Maintain basic bookkeeping (income/expenses). Pay Income Tax on profits.

- Registering as an MSME (Udyam): Highly recommended even as a sole proprietor. It’s free, boosts credibility, and may offer benefits later. Use Activity Code 99969 – Other Personal Service Activities n.e.c.

- Forming a Partnership Firm or LLP: As you grow or partner with others. Offers some liability protection (LLP more than Partnership). Requires formal registration (Registrar of Firms for Partnership, MCA for LLP), PAN, GST if turnover crosses threshold.

- Forming a Private Limited Company: For larger scale, hiring employees, significant investment. Highest compliance but strongest structure. Overkill for most starters.

- GST Registration: Mandatory once your annual turnover exceeds ₹20 lakhs (₹10 lakhs in special category states). Even below threshold, voluntary registration adds professionalism and allows claiming ITC if you have expenses. Apply via GSTN portal. You’ll fall under SAC 998316 (Other support services n.e.c.) or potentially 998317 (Document preparation services).

- Professional Tax (PT): Applicable in most states if you earn above a threshold. Register with the state labour department.

- Current Account: Open a dedicated business bank account. Never mix personal and business finances.

- Agreements: For larger clients or recurring work (e.g., monthly GST filing), a simple Service Agreement outlining scope, fees, timelines, confidentiality, and data handling is wise.

4.2 Setting Up Efficient Operations: Your Service Delivery Engine

Smooth operations build reputation and allow scaling.

- The Client Onboarding Process:

- Initial Contact: (Call, WhatsApp, Email). Briefly understand their need.

- Consultation: (Free or Paid). Discuss details, explain process, clearly state your fee and govt fees, outline data security practices. Get explicit verbal/written consent.

- Document Collection: Securely (WhatsApp encrypted? Secure cloud upload link?). Provide a detailed checklist of exactly what you need. Be specific about formats (PDF, clear JPG, size limits).

- Service Agreement & Payment: For larger/complex jobs, a simple email confirmation suffices initially. Collect advance payment (e.g., 50%) or full payment upfront for smaller jobs. Use UPI, bank transfer. Issue a receipt (digital is fine).

- Service Execution:

- Verify Documents: Check validity, name matches, dates. Flag any issues immediately.

- Form Filling: Meticulously enter data. Double-check critical fields (ID numbers, bank details, amounts). Save progress frequently.

- Client Review (Crucial for sensitive forms like ITR, GST Reg): Share a preview (screenshot, PDF draft) for their approval before final submission. Explain key entries.

- Submission: Complete the process on the portal. Capture the Application Reference Number (ARN), Transaction ID, or screenshot proof.

- Confirmation: Immediately inform the client submission is done, share the reference number, and outline next steps/expected timeline.

- Tracking & Follow-up:

- Monitor application status periodically using the reference number on the respective portal.

- Proactively inform the client of status updates (e.g., “Application received,” “Under processing,” “Approved,” “Deficiency noted”).

- If a deficiency notice arrives, guide the client on rectifying it (gathering new docs, clarifying information) and help resubmit promptly. This is often billable extra time.

- Confirm final outcome (e.g., “PAN card dispatched,” “GSTIN activated,” “Passport received”).

- Document Management & Security:

- Secure Cloud Storage: Use folders per client (e.g., ClientName_Service_Date). Encrypt sensitive documents locally before upload if possible.

- Data Retention Policy: Define how long you keep client documents after service completion (e.g., 6 months). Securely delete them afterward (shredding software for digital files).

- Never Share Credentials: You should never ask for or use a client’s login ID/password for government portals. You guide, they input OTPs or you use preview modes. Your role is advisory and assistance, not impersonation. This is critical for security and ethics.

- Tools for Efficiency:

- CRM (Customer Relationship Management): Start simple (spreadsheet: Client Name, Contact, Service, Date, Fee, Status, Notes). Upgrade to free/low-cost tools like HubSpot CRM or Zoho CRM as you grow.

- Project Management: Use Trello, Asana, or even Google Tasks to track each client job stage (Doc Received, Form Filled, Client Review, Submitted, Tracking, Completed).

- Templates: Create standard checklists (doc requirements per service), email templates (confirmation, status update), and form guides for common services to save time.

4.3 Finding Your Clients: Marketing Strategies That Work

You need visibility. Use a mix of online and offline tactics.

- Leverage Your Personal Network (Immediate Start):

- Tell friends, family, former colleagues exactly what you do. Be specific (“I help with GST filing for small shops”).

- Ask for referrals explicitly. Offer a small discount for successful referrals.

- Hyper-Local Offline Marketing (Powerful in Tier 2/3/Rural):

- Flyers & Posters: Design simple, clear flyers listing your key services and contact info. Distribute in:

- Local markets (near shops).

- Residential societies (notice boards).

- Colleges (scholarship time).

- Senior citizen clubs.

- Near RTOs, Passport Seva Kendras (be ethical, don’t harass).

- Business Cards: Always carry them. Hand them out everywhere relevant.

- Local Partnerships:

- Small Shopkeepers: Offer their customers a small discount. Leave flyers/cards. (e.g., “Get 10% off GST filing from [Your Name] when you mention [Shop Name]”).

- Printing/Cyber Cafes: They often get asked for form help but can’t provide it. Partner with them for referrals. Offer commission.

- Local CAs/CS/Advocates (for overflow/simple work): Introduce yourself professionally. Offer to handle basic form filling they find too time-consuming. Be reliable.

- Resident Welfare Associations (RWAs): Offer to give a free talk on “Simplifying Online Government Services” or distribute flyers to members.

- Flyers & Posters: Design simple, clear flyers listing your key services and contact info. Distribute in:

- Online Marketing (Essential for Reach & Credibility):

- WhatsApp Business Profile: Set it up professionally (Profile pic, description, business hours, website link). Use Broadcast Lists sparingly and ethically for service updates/tips.

- Facebook:

- Personal Profile: Share your services, success stories (with client permission), informative posts about form deadlines/tips.

- Facebook Business Page: Create one. Post regularly: tips, process explanations, client testimonials, “Did You Know?” facts. Run highly targeted local ads (e.g., “GST Filing Help in [Your City]” targeting small business owners).

- Local Community Groups: Join relevant groups (e.g., “[Your City] Business Network,” “Residents of [Area]”). Don’t spam! Provide genuine value by answering questions related to government forms. Establish yourself as the helpful expert. Subtly mention your services when appropriate.

- Instagram: Use Stories/Reels for quick tips (“3 docs needed for PAN correction”), infographics. Good for reaching younger demographics (students, entrepreneurs).

- Google My Business (GMB): CRITICAL. Create a free listing. Add your business category (e.g., “Document Preparation Service,” “Tax Preparation Service”). Add photos, detailed service descriptions, hours, contact info. Encourage satisfied clients to leave reviews. This makes you appear in local “government form help” searches.

- Simple Website/Blog: Even a single-page site (using Carrd.co, Canva Websites) adds legitimacy. List services, fees (or starting prices), contact info. A blog with articles like “Step-by-Step Guide to Udyam Registration 2024” attracts organic search traffic (SEO) and establishes authority.

- Freelance Platforms (Use Cautiously): Sites like Fiverr, Upwork, WorknHire. Pros: Access to clients. Cons: High fees, competition, low-ball pricing, potential for difficult clients. If using, focus on specific niches and price fairly for your expertise.

- YouTube Channel (Long-Term Play): Create short tutorials on common processes (e.g., “How to Update Aadhaar Address Online”). Link to your services in descriptions. Builds massive trust and authority over time.

- Content Marketing (The Trust Builder):

- Write short, helpful posts/articles on LinkedIn/Facebook/your blog.

- Create simple infographics explaining processes.

- Share government updates and deadlines relevant to your audience.

- Answer questions in online forums (Quora, Reddit – ethically, without blatant promotion). Position yourself as the knowledgeable helper.

Key Marketing Principle: Focus on solving problems, not just selling services. Be the helpful guide, and the clients will follow.

Part 5: Scaling Your Income – Beyond One-on-One Help

Once you have a steady flow of clients, explore ways to increase your impact and income without linearly increasing your hours.

- Developing Standardized Packages & Products:

- “DIY Kits”: Create detailed, step-by-step PDF guides or video courses for popular but relatively simpler services (e.g., “Your Complete Guide to Aadhaar Address Update”). Sell these online (your website, Gumroad, Instamojo) for a lower price point (₹199-₹499). Leverage your expertise at scale.

- Template Packs: Offer downloadable checklists, document lists, and pre-filled form templates (where possible) for common services. Ensure they are guides, not facilitating impersonation.

- Building a Team:

- Virtual Assistants (VAs): Delegate administrative tasks (scheduling, initial client screening, sending reminders, basic document sorting) to a VA. Frees you for core form-filling and complex consultations.

- Junior Form Fillers: Train reliable individuals (college students, part-timers) on specific, standardized services (e.g., PAN new applications, Aadhaar updates). You handle client intake, quality control, and complex cases. Pay them a fixed fee per form or hourly rate. Requires good training and supervision systems.

- Partnering with Businesses (B2B):

- Small Businesses: Offer retainer packages for their ongoing compliance needs (e.g., monthly GST filing, PT returns, annual returns). Provides predictable income.

- Startups/Co-working Spaces: Offer exclusive discounts or workshops for their members.

- HR Consultancies: Partner to handle EPF/ESI registrations and employee documentation for their client companies.

- Real Estate Agents: Offer property document verification, EC application, and online tax payment services for their clients.

- Workshops & Training:

- Conduct paid group workshops (“Master Your GST Filing,” “Simplify Your ITR”) for small business owners or senior citizens. Charge per attendee.

- Offer training programs for other aspiring form-fillers, leveraging your expertise. Ensure quality and ethics are core.

- Referral Network: Build a formal referral network with complementary professionals (CAs for complex tax, lawyers for property disputes, insurance agents). Refer clients appropriately and negotiate referral fees.

- Technology Leverage: Explore simple software tools or scripts (developed ethically) that can automate parts of data entry where possible and secure (e.g., populating client details from a template). Never compromise security or accuracy.

Scaling Ethically: As you grow, never compromise on your core values: accuracy, data security, client confidentiality, and ethical conduct. Your reputation is your most valuable asset.

This business involves trust and sensitive data. Navigate carefully.

- Core Ethical Principles:

- Honesty & Transparency: Never guarantee outcomes (approval is the government’s decision). Be clear about what you can and cannot do. Disclose fees upfront. Never misrepresent your qualifications.

- Client Confidentiality: Treat all client information as sacred. Never disclose or misuse it. Have a clear data security and destruction policy.

- No Impersonation: Never log into a government portal using the client’s credentials. Your role is to guide, assist, and fill forms with the client or based on their provided information. They should input OTPs. If a portal requires the client’s physical presence (e.g., Passport appointment, Aadhaar biometrics), guide them, don’t pretend to be them.

- Know Your Limits: Don’t venture into areas requiring professional licenses (giving legal advice, complex tax planning, financial advice). Stick to form filling and process guidance. Refer clients to CAs, lawyers, or financial advisors when needed.

- Avoid “Guaranteed Approval” Traps: Touts often promise this. Don’t. You ensure the form is filled correctly and completely based on client info. Approval is not in your hands.

- Fair Pricing: Charge fairly for the value provided and your expertise. Avoid exploitative pricing, especially for vulnerable populations.

- Common Pitfalls & How to Avoid Them:

- Data Breaches: The Biggest Risk. Use strong passwords, 2FA, encrypted cloud storage, secure devices, and train any staff. Never share client data unnecessarily. Delete data securely post-retention period.

- Mistakes & Omissions: Double and triple-check. Use checklists. Have a peer review for complex forms if possible. Offer a clear policy for rectifying genuine errors made by you (e.g., free correction support).

- Missed Deadlines: Use calendars with reminders religiously, especially for GST returns, ITR filing, and scholarship deadlines. Set client expectations realistically.

- Unrealistic Client Expectations: Manage expectations clearly upfront. Explain processing times, potential delays, and that you facilitate the application, not the decision.

- Payment Disputes: Get clear agreements (even via email/WhatsApp). Collect advance payments, especially for larger jobs. Use UPI/bank transfer for traceability.

- Burnout: Set clear working hours. Learn to say no when overloaded. Delegate where possible. Take breaks.

- Competition & Undercutting: Focus on your value (accuracy, professionalism, trust, convenience). Don’t race to the bottom on price. Compete on quality and service.

- Regulatory Changes: Stay constantly updated. Ignorance is not an excuse. Subscribe to official updates.

- Legal Compliance Reminder:

- GST Registration: Mandatory over threshold.

- Income Tax: File your ITR accurately. Pay taxes on time.

- MSME/Udyam Registration: Maintain it.

- Professional Tax: Register if applicable.

- Contracts: Use simple agreements for larger/ongoing work.

- Avoid Illegal Activities: Never forge documents, bribe officials, or engage in fraudulent applications. It’s not worth the risk.

Your Integrity is Your Brand: In a field sometimes associated with touts, being the ethical, reliable professional is a massive competitive advantage. Build trust meticulously.

Part 7: The Road Ahead – Future Trends & Your Evolving Role

The digital governance landscape is dynamic. Stay ahead of the curve.

- Increased Digitization & New Portals: Expect more services to move online, requiring you to constantly learn new systems. State-specific portals will evolve.

- AI & Automation (Opportunity & Threat): Governments might introduce more AI chatbots or automated form pre-fill. Your Opportunity: Focus on complex cases, hand-holding for the digitally excluded, verification, error resolution, and personalized guidance that AI cannot provide. Use AI tools yourself for research and efficiency.

- Enhanced Security (Aadhaar Based, Biometrics): More processes will integrate Aadhaar authentication and biometrics. Ensure you understand these systems and respect the protocols (e.g., client presence needed for biometrics).

- Rise of Government-Authorized Facilitation Centers (CSCs): CSCs will likely expand. Position yourself as a more personalized, specialized, or remote alternative. Consider becoming a CSC VLE if it aligns with your goals.

- Growing Demand in Rural & Semi-Urban Areas: As internet penetration deepens, demand in smaller towns and villages will surge. Remote service capabilities position you well.

- Increased Focus on Data Privacy: Regulations like the Digital Personal Data Protection Act (DPDPA) will impose stricter rules on handling client data. Ensure your practices comply proactively.

- Consolidation & Specialization: The market might see larger players emerge. Deep specialization (e.g., “GST Compliance for Restaurants,” “Pension Application Experts for Armed Forces”) will be key for premium positioning.

- Your Role Evolution: From form-filler to trusted Digital Governance Advisor. Providing proactive advice (“You should apply for Udyam for these benefits”), compliance health checks, and ongoing support beyond just filling the next form.

Continuous Learning is Non-Negotiable: Dedicate time weekly to update your knowledge. Adaptability is your superpower.

Conclusion: Your Journey from Confusion to Cash Starts Now

Helping people navigate the complex world of online government forms in India is more than just a business; it’s a vital service that empowers citizens, supports businesses, and fuels the Digital India dream. You bridge the gap between daunting technology and essential services.

You’ve learned:

- The Immense Need: Millions struggle daily, creating a vast, sustainable market.

- Your Value: You provide clarity, accuracy, speed, and priceless peace of mind.

- The Skills & Knowledge: Digital prowess, meticulousness, empathy, and deep understanding of key portals and processes are your foundation.

- The Service Spectrum: From PAN cards and Aadhaar updates to GST filing and pension claims – a diverse menu of profitable services.

- Building the Business: Legal setup, ethical pricing, efficient operations, and client management are key.

- Finding Clients: Leverage local networks, online marketing (especially Google My Business), and hyper-local outreach.

- Scaling Smartly: Explore DIY kits, team building, B2B partnerships, and workshops.

- Navigating Risks: Prioritize data security, maintain ethical standards, know your limits, and stay legally compliant.

- The Future: Embrace continuous learning, adapt to digitization trends, and evolve your role.

The opportunity is real, tangible, and deeply rewarding. You don’t need a massive investment, just dedication, a willingness to learn, a commitment to accuracy, and a genuine desire to help people overcome bureaucratic hurdles.

Your Action Plan (Start Today!):

- Pick Your Niche: Start with 2-3 high-demand, relatively simpler services (e.g., PAN, Aadhaar Update, Voter ID). Master them.

- Deep Dive Learning: Spend the next week obsessively learning the official portals and processes for your chosen services. Practice with dummy data.

- Set Up Your Basics: Create a professional WhatsApp Business profile. Set up a simple Google Drive folder structure. Open a separate bank account. Register on Udyam.

- Define Your Pricing: Research competitors, calculate your costs, and set fair, transparent prices for your starter services. Create a simple price list.

- Announce Your Launch: Tell your personal network. Post on social media (Facebook/LinkedIn). Print 50 simple flyers and distribute them locally.

- Land Your First Client: Offer a discounted rate to your first 3 clients in exchange for honest feedback and a testimonial if satisfied.

- Deliver Excellence: Be meticulous, communicative, and secure with their data. Underpromise and overdeliver.

- Iterate & Grow: Gather feedback, refine your processes, add new services gradually, and scale using the strategies outlined.

The digital labyrinth of government forms exists. Millions are lost within it. You hold the map and the flashlight. Start guiding them today, and build a meaningful, profitable venture in the process.