How to Find the Best Cryptocurrency to Invest in for Beginners in 2025

Crypto: The crypto market is buzzing with excitement, and 2025 is set to make it even more thrilling! But for beginners, the big question remains: “Which should I invest in?” If you’re wondering the same, this article is for you. We won’t give you boring, generic advice here. This is a detailed, beginner-friendly guide that will walk you through, step-by-step, on how to choose the right crypto and grow your investment smartly. So, let’s get started!

Why is there so much buzz in the crypto market?

Simple—there are massive growth opportunities here. Coins like Bitcoin have made people millionaires, and new projects are launching every day. But the truth is, the risk is just as big. In 2025, the crypto market has matured, but volatility still persists.

Real-Life Example: Imagine if you had invested ₹10,000 in Ethereum in 2020—today, it could be worth lakhs! On the flip side, some coins crash to zero. A friend told me he invested ₹50,000 in a hyped coin in 2021, and that coin is practically worthless now. Lesson? Research is crucial!

Moreover, in 2025, blockchain technology is being used more widely—in gaming, healthcare, and even voting systems. So, crypto isn’t just a way to make money; it’s a part of the future. But for beginners, the biggest challenge is: Which coin to choose? Let’s find the answer.

Read more:

- Why Smart Contract Stock Trading Is the Future of Wealth

- Harnessing Big Data for Smarter Stock Market Decisions

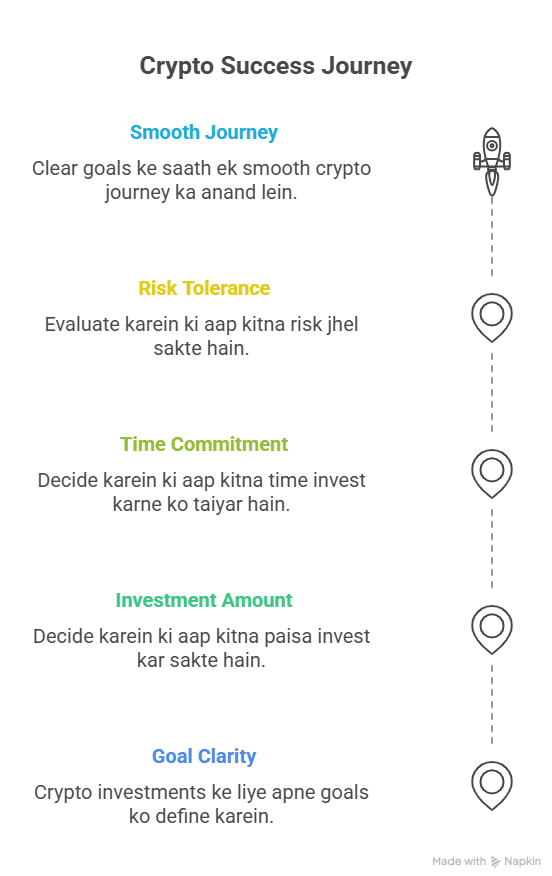

Before diving into crypto, clarify your purpose. Are you aiming for long-term investment or short-term trading? Do you want a stable coin or a high-risk, high-reward opportunity?

Investing in crypto is a big decision, and it starts with understanding your goal. Without a clear plan, you risk losing money or feeling overwhelmed. So, first ask yourself: “Why do I want to invest in crypto?” This section will explain this in detail to help you create a solid plan. Let’s break it down step by step.

The crypto market is like a jungle—full of options, risks, and excitement. Without a goal, you can easily get lost. Your goal is your compass, guiding you in the right direction. For example, if your aim is to save for a house down payment in 5 years, your investment strategy will differ from someone who wants to trade daily for quick profits.

Real-Life Example: My friend Shalini invested in crypto in 2022 with the goal of buying her dream bike in a year. She chose high-risk altcoins for quick returns. But when the market crashed, she lost 70% of her investment. If she had a clear long-term goal, she might have picked stable coins like Bitcoin or Ethereum and avoided the loss. Moral? A clear goal saves you from mistakes.

Here are some questions to help you clarify your goal:

What’s My Target?

Do you want to achieve a big financial goal, like buying a house, a car, or building a retirement fund? Or are you looking for some extra income? For instance, if you’re investing for 10 years, you’ll focus on stable coins like Bitcoin or Ethereum. But if you want quick profits in 6 months, you might try trading or new altcoins.

How Much Time Can I Commit?

Your time horizon matters a lot in crypto. Long-term investors (5–10 years) worry less about market ups and downs because they know markets can recover. Short-term traders (1–12 months) need to monitor daily market movements. Ask yourself: Are you ready to check charts daily, or do you want to invest and forget?

How Much Risk Can I Handle?

Crypto is highly volatile. One day your coin could be up 30%, the next day down 40%! Can you handle that stress? If losses make you nervous, stick to stable coins. If you’re up for adventure, you can try high-risk, high-reward coins.

How Much Money Can I Invest?

This is the biggest question. Only invest what you can afford to lose. For example, if you save ₹10,000 monthly, you might allocate ₹1,000–2,000 to crypto. Never put your life savings or emergency fund into crypto.

Case Study: Rahul, a 30-year-old IT professional, invested ₹50,000 in crypto in 2023. His goal was to save for his wedding in 3 years. He built his portfolio: 60% Bitcoin, 30% Ethereum, and 10% Solana. Despite market volatility, he didn’t panic because his goal was long-term. Today, his investment is worth ₹80,000, and he’s close to his target. Rahul’s clear goal helped him stay calm through market ups and downs.

How to Set Your Goal

Now that you’ve thought about why you want to invest, follow these steps:

- Fix Your Budget: Decide how much you can invest monthly or yearly in crypto. For example, if you save ₹5,000 monthly, allocate ₹500–1,000 for crypto. This should be money that doesn’t affect your daily expenses or emergency fund.

- Write Down Your Time Horizon: In a notebook, note your goal and timeframe. For example: “I want to build a ₹5 lakh crypto portfolio in 5 years.” Writing it down keeps you focused.

- Check Your Risk Tolerance: Ask yourself: “If my ₹10,000 investment drops to ₹5,000, will I panic?” If the answer is “yes,” choose low-risk coins. If “no,” you can experiment a bit.

- Make a Plan: Decide your strategy. For long-term goals, HODL (Hold On for Dear Life) is best, where you invest and forget. For short-term goals, try trading or swing trading, but it requires time and knowledge.

Pro Tip: Dollar Cost Averaging (DCA) is a smart strategy. You invest a fixed amount monthly, regardless of market conditions. This lets you buy more units when prices are low and fewer when prices are high. For example, if you invest ₹2,000 in Bitcoin monthly, you’ll benefit from market dips, making it profitable in the long run.

Common Mistakes to Avoid

Beginners often make these mistakes when setting goals:

- Investing Without a Plan: People buy coins in the hype without knowing their goal. For example, in 2021, many invested in Dogecoin due to hype, but when it crashed, they lost everything.

- Overconfidence: Newbies think they’ll become millionaires in a month. Crypto requires patience.

- Emotional Decisions: When the market drops, people panic and sell. If your goal is long-term, don’t worry about short-term volatility.

Example: I spoke to a colleague new to crypto who invested ₹20,000 in a memecoin in 2024 because his friend said, “This coin will moon!” He had no goal or research. Within a month, the coin crashed 90%. If he had set a clear goal, he might have avoided such a risky bet.

Why Goal Setting in 2025 Is Different

In 2025, the crypto market is more mature. Government regulations, taxes, and institutional investments are now part of the scene. In India, there’s a 30% crypto tax and 1% TDS, which affects your returns. Keep these in mind when setting your goal:

- Tax Planning: Set aside 30% of your profits for taxes to avoid surprises later.

- Market Trends: In 2025, layer-2 solutions, DeFi, and Web3 projects are big trends. Align your goal with these. For example, if you love gaming, research gaming-focused coins like Axie Infinity or Immutable X.

- Global Factors: Crypto markets are affected by global events, like US interest rates or China’s crypto bans. For long-term goals, stay aware of these factors.

Would you like me to search for real-time data on 2025 crypto trends or analyze specific coins mentioned, like Bitcoin or Ethereum, to help refine your investment goals?Before diving into crypto, clarify your purpose. Are you aiming for long-term investment or short-term trading? Do you want a stable coin or a high-risk, high-reward opportunity?

Investing in crypto is a big decision, and it starts with understanding your goal. Without a clear plan, you risk losing money or feeling overwhelmed. So, first ask yourself: “Why do I want to invest in crypto?” This section will explain this in detail to help you create a solid plan. Let’s break it down step by step.

The crypto market is like a jungle—full of options, risks, and excitement. Without a goal, you can easily get lost. Your goal is your compass, guiding you in the right direction. For example, if your aim is to save for a house down payment in 5 years, your investment strategy will differ from someone who wants to trade daily for quick profits.

Real-Life Example: My friend Shalini invested in crypto in 2022 with the goal of buying her dream bike in a year. She chose high-risk altcoins for quick returns. But when the market crashed, she lost 70% of her investment. If she had a clear long-term goal, she might have picked stable coins like Bitcoin or Ethereum and avoided the loss. Moral? A clear goal saves you from mistakes.

Here are some questions to help you clarify your goal:

What’s My Target?

Do you want to achieve a big financial goal, like buying a house, a car, or building a retirement fund? Or are you looking for some extra income? For instance, if you’re investing for 10 years, you’ll focus on stable coins like Bitcoin or Ethereum. But if you want quick profits in 6 months, you might try trading or new altcoins.

How Much Time Can I Commit?

Your time horizon matters a lot in crypto. Long-term investors (5–10 years) worry less about market ups and downs because they know markets can recover. Short-term traders (1–12 months) need to monitor daily market movements. Ask yourself: Are you ready to check charts daily, or do you want to invest and forget?

How Much Risk Can I Handle?

Crypto is highly volatile. One day your coin could be up 30%, the next day down 40%! Can you handle that stress? If losses make you nervous, stick to stable coins. If you’re up for adventure, you can try high-risk, high-reward coins.

How Much Money Can I Invest?

This is the biggest question. Only invest what you can afford to lose. For example, if you save ₹10,000 monthly, you might allocate ₹1,000–2,000 to crypto. Never put your life savings or emergency fund into crypto.

Case Study: Rahul, a 30-year-old IT professional, invested ₹50,000 in crypto in 2023. His goal was to save for his wedding in 3 years. He built his portfolio: 60% Bitcoin, 30% Ethereum, and 10% Solana. Despite market volatility, he didn’t panic because his goal was long-term. Today, his investment is worth ₹80,000, and he’s close to his target. Rahul’s clear goal helped him stay calm through market ups and downs.

How to Set Your Goal

Now that you’ve thought about why you want to invest, follow these steps:

- Fix Your Budget: Decide how much you can invest monthly or yearly in crypto. For example, if you save ₹5,000 monthly, allocate ₹500–1,000 for crypto. This should be money that doesn’t affect your daily expenses or emergency fund.

- Write Down Your Time Horizon: In a notebook, note your goal and timeframe. For example: “I want to build a ₹5 lakh crypto portfolio in 5 years.” Writing it down keeps you focused.

- Check Your Risk Tolerance: Ask yourself: “If my ₹10,000 investment drops to ₹5,000, will I panic?” If the answer is “yes,” choose low-risk coins. If “no,” you can experiment a bit.

- Make a Plan: Decide your strategy. For long-term goals, HODL (Hold On for Dear Life) is best, where you invest and forget. For short-term goals, try trading or swing trading, but it requires time and knowledge.

Pro Tip: Dollar Cost Averaging (DCA) is a smart strategy. You invest a fixed amount monthly, regardless of market conditions. This lets you buy more units when prices are low and fewer when prices are high. For example, if you invest ₹2,000 in Bitcoin monthly, you’ll benefit from market dips, making it profitable in the long run.

Common Mistakes to Avoid

Beginners often make these mistakes when setting goals:

- Investing Without a Plan: People buy coins in the hype without knowing their goal. For example, in 2021, many invested in Dogecoin due to hype, but when it crashed, they lost everything.

- Overconfidence: Newbies think they’ll become millionaires in a month. Crypto requires patience.

- Emotional Decisions: When the market drops, people panic and sell. If your goal is long-term, don’t worry about short-term volatility.

Example: I spoke to a colleague new to crypto who invested ₹20,000 in a memecoin in 2024 because his friend said, “This coin will moon!” He had no goal or research. Within a month, the coin crashed 90%. If he had set a clear goal, he might have avoided such a risky bet.

Why Goal Setting in 2025 Is Different

In 2025, the crypto market is more mature. Government regulations, taxes, and institutional investments are now part of the scene. In India, there’s a 30% crypto tax and 1% TDS, which affects your returns. Keep these in mind when setting your goal:

- Tax Planning: Set aside 30% of your profits for taxes to avoid surprises later.

- Market Trends: In 2025, layer-2 solutions, DeFi, and Web3 projects are big trends. Align your goal with these. For example, if you love gaming, research gaming-focused coins like Axie Infinity or Immutable X.

- Global Factors: Crypto markets are affected by global events, like US interest rates or China’s crypto bans. For long-term goals, stay aware of these factors.

Would you like me to search for real-time data on 2025 crypto trends or analyze specific coins mentioned, like Bitcoin or Ethereum, to help refine your investment goals?

Takeaway: Apna Goal Aapka Roadmap Hai

The first step to success in crypto is clarifying your goal. This not only helps you choose the right coins but also keeps you calm during market ups and downs. So, grab a pen and paper today and write:

- What is my goal?

- How much money can I invest?

- How much time will I commit?

- How much risk can I handle?

Once this is clear, your crypto journey will be much smoother. The next step is research, but that comes later! For now, solidify your “why,” as it will keep you steady through the market’s storms.

Would you like me to dive deeper into how to research coins or provide tips on specific strategies for 2025?hoga.

The detailed explanation gives you a comprehensive understanding of goal-setting from every angle. If you need clarity on any specific point, let me know!

Case Study: Priya, a 25-year-old marketing professional, developed an interest in crypto in 2023. She invested ₹20,000 in Bitcoin because she wanted long-term growth. On the other hand, her brother Rohan traded in altcoins and made ₹10,000 in a week but lost the same amount the next week. Priya’s clear goal kept her investment safe.

What to Do?

- Decide your budget. Only invest what you can afford to lose.

- Fix your time horizon: 1 year, 5 years, or longer?

- Check your risk tolerance. Can you handle a 50% loss?

If these are clear, you’ve already won half the battle. The next step is—research.

Response to Your Request: If you want me to dive deeper into any specific part (e.g., budgeting, time horizon, risk tolerance, or research) or apply this to your own goals, please share more details. For example, I can help calculate a safe investment amount, suggest a time horizon, assess risk tolerance with a quiz, or provide a crypto research checklist. Alternatively, I can analyze a specific cryptocurrency based on current data from X or the web. Which point would you like to explore further?rch.

Step 2: Research Karo—Kaunsa Coin Best Hai?

Which Cryptocurrency to Choose? A Detailed Guide to Picking the Right Coin

The crypto market is flooded with thousands of coins—Bitcoin, Ethereum, Solana, Cardano, and even new memecoins. But which one is right for you? It depends on your goals, risk tolerance, and investment strategy. This section will explain in detail how to research and which factors to check to choose the best coin for you. This guide is beginner-friendly, and we’ll use real-life examples and case studies to explain each point. Let’s get started!

Why Is Research Important?

The crypto market is a roller-coaster—prices can skyrocket one day and crash the next. Investing without research is like shooting an arrow in the dark. Solid research saves you from mistakes and boosts your chances of long-term success. For example, if you had invested ₹5,000 in Solana in 2020 when it was around $1, by 2025, with its price above $150, your investment would be worth lakhs! On the flip side, many coins go to zero because they lack a solid project behind them.

Case Study: In 2021, a coin called “Squid Game” launched, based on the popular Netflix show. People invested crores in the hype, but within a week, the coin crashed, and the developers scammed everyone by disappearing with the funds. Those who researched avoided this scam. Moral? Always do your research!

Which Coin to Choose? Check These Factors

Researching crypto means understanding the project, team, technology, and market potential behind a coin. Here are 5 key factors to check for every coin:

1. What Is the Project’s Purpose?

Every cryptocurrency is backed by a blockchain project. What’s its mission? Does it solve a real-world problem? For example:

- Bitcoin (BTC): Seen as “digital gold,” it’s used as an inflation hedge and store of value.

- Ethereum (ETH): The largest platform for smart contracts and decentralized apps (dApps).

- Solana (SOL): Popular for fast transactions and low fees, especially in gaming and NFTs.

If a coin lacks a clear purpose or runs purely on hype (like memecoins), it’s riskier. When researching, read the coin’s whitepaper—a document that explains the project’s goals and technology.

Example: Chainlink (LINK) is a decentralized oracle network that connects real-world data to blockchains. It’s useful for banks, insurance companies, and DeFi projects. Its solid use case has made Chainlink a strong performer in 2025.

2. Team and Community

Check the team behind the coin. Do they have solid experience? Are they transparent? Look at their LinkedIn or X profiles. For example, Cardano’s founder, Charles Hoskinson, was a co-founder of Ethereum, which adds credibility to the project.

The community is equally important. An active community boosts a coin’s adoption and success. Check Telegram, Reddit, or X to see how active the coin’s fans are. For example, Dogecoin’s passionate community, backed by celebrities like Elon Musk, helped it skyrocket in 2021. But remember, community hype isn’t always a substitute for solid fundamentals.

Case Study: In 2024, Solana’s community launched several meme coins (like Dogwifhat and Bonk) that went viral. This boosted Solana’s adoption, but when the market corrected, these meme coins dropped by up to 80%. So, check the community but also verify the project’s fundamentals.

3. Market Cap and Trading Volume

Market cap shows how big a coin is. It’s the product of the coin’s price and circulating supply. High market cap coins (like Bitcoin, with a $1 trillion+ market cap) are more stable, while low market cap coins (like new altcoins) are more volatile.

Check trading volume too—it shows how liquid a coin is. High volume means you can easily buy or sell. Platforms like CoinMarketCap or CoinGecko provide this data. For example, Bitcoin’s daily trading volume is in the billions, making it highly liquid.

Pro Tip: Low market cap coins have high return potential but come with equally high risk. If you’re a beginner, start with top 10 market cap coins (like BTC, ETH, SOL).

4. Technology and Scalability

Check the coin’s technology—is it fast, secure, and scalable? For example:

- Solana: Can process thousands of transactions per second with fees around $0.00025. However, it has a history of network outages, raising reliability concerns.

- Ethereum: The king of smart contracts, set to become more scalable with the “Pectra” upgrade in 2025.

- Polkadot: Connects different blockchains, making it a game-changer for interoperability.

Scalability refers to how many users and transactions a network can handle. In 2025, layer-2 solutions (like Polygon or Optimism) and high-speed blockchains (like Solana, Sui) are trending.

Example: Polygon (MATIC) is a layer-2 solution for Ethereum, making transactions faster and cheaper. Its partnerships (like Disney and Starbucks) and low fees make it a solid pick in 2025.

Next Steps

If you want clarity on any specific factor (e.g., evaluating a project’s purpose, researching a team, checking market cap, or understanding tech), let me know, and I can dive deeper with examples or tools. For instance:

- I can analyze a specific coin (e.g., Bitcoin, Solana, or a memecoin) using current X posts or web data.

- I can provide a checklist for reading whitepapers or spotting scams.

- If you share your goals (budget, time horizon, risk tolerance), I can suggest coins that align with them.

Which factor or coin do you want to explore further? Or do you have a personal investment goal to discuss? banaya hai.

5. Regulatory aur Market Sentiment

How to Navigate the Crypto Market: Global Regulations, Sentiment, and Research Tools

The crypto market is heavily influenced by global regulations and sentiment. For instance, India’s 30% crypto tax and 1% TDS (Tax Deducted at Source) reduce your returns, while in the US, Donald Trump’s pro-crypto policies, like the Strategic Bitcoin Reserve, have driven bullish sentiment in 2025. Let’s break down the key points, check X sentiment, and provide actionable steps for research and investment, especially for beginners.

X Sentiment on Cryptocurrencies in 2025

Based on recent posts on X, here’s the current sentiment around cryptocurrencies, focusing on the topics you mentioned:

- SUI Inflows: A post from @coinbureau highlights that SUI is seeing higher inflows than Solana, indicating growing popularity. This suggests investors are optimistic about SUI’s potential, possibly due to its high-speed blockchain and DeFi applications. However, this is sentiment-based and needs cross-checking with fundamentals like SUI’s whitepaper or on-chain data.

- Donald Trump’s Strategic Bitcoin Reserve: X posts reflect mixed sentiment. Trump’s announcement of a US crypto reserve including Bitcoin, Ethereum, XRP, Solana, and Cardano initially spiked prices (e.g., Bitcoin to $94,164, XRP up 33%, Solana up 25%, Cardano up 60%). However, disappointment followed when the executive order clarified that only existing seized Bitcoin (about 200,000 BTC, worth ~$17 billion) would form the reserve, with no new purchases. Some users, like @coinbureau, noted that altcoins like XRP were excluded from the final order, dampening enthusiasm. Critics argue the reserve is more symbolic (“a pig in lipstick”), while supporters see it as a step toward mainstream adoption.

- India’s Crypto Tax (30% + 1% TDS): X sentiment in India is cautiously optimistic. A post from @coinbureau highlights a significant shift: India’s Supreme Court advocated regulating crypto rather than banning it, calling a ban “like denying reality.” This has fueled hope for a more balanced tax framework, though the current 30% flat tax and 1% TDS are seen as hurdles, pushing trading to offshore exchanges. Investors are frustrated as these taxes discourage long-term holding and add compliance burdens.

- XRP Legal Issues (2024): XRP’s sentiment is bullish due to regulatory clarity. @coinbureau noted that Ripple’s legal chief confirmed XRP’s non-security status in 2024, despite a procedural setback with the SEC. This clarity led major exchanges to relist XRP, driving its price to $0.52—a massive 8,497% growth from $0.006 in 2017. Posts also mention WisdomTree naming XRP as a top altcoin to complement Bitcoin, boosting confidence. However, some skepticism remains due to ongoing SEC-related discussions and delays in ETF approvals.

X Sentiment Summary: The crypto community on X is cautiously bullish, driven by US pro-crypto policies and XRP’s legal wins, but tempered by concerns over India’s high taxes and the limited scope of Trump’s reserve. SUI’s rising inflows signal growing interest in new projects, but hype-driven sentiment needs validation. Always cross-check X posts with official sources like whitepapers or CoinMarketCap, as misinformation is common.

Case Study: XRP’s 2024 Growth

XRP’s growth in 2024 showcases the power of regulatory clarity. After years of legal battles with the SEC over whether XRP sales in 2012 were unregistered securities, Ripple mostly won the case, with the SEC securing only a partial victory. This resolution led major exchanges like Coinbase and Binance to relist XRP, boosting its price to $0.52—a staggering 8,497% increase from its 2017 low of $0.006. This highlights how regulatory clarity can drive adoption and price growth, making XRP a strong performer in 2025.

How to Research: Tools and Sources

To choose the right coin, use these tools and sources for thorough research:

- CoinMarketCap and CoinGecko: Track market cap, trading volume, price history, and project details. These platforms provide reliable data to compare coins.

- Whitepapers: Found on a coin’s official website, whitepapers detail the project’s vision, technology, and roadmap. For example, Chainlink’s whitepaper explains its role in connecting real-world data to blockchains.

- X and Reddit: Gauge community sentiment and catch breaking news. Check X for posts from credible accounts like @coinbureau, but always verify with primary sources due to misinformation risks.

- News Websites: Cointelegraph, CoinDesk, and Forbes’ crypto sections offer updates on regulations, market trends, and project developments.

- Blockchain Explorers: Use Etherscan (for Ethereum) or Solscan (for Solana) to verify transactions and network activity, ensuring a project’s legitimacy.

Pro Tip: Create a spreadsheet to compare coins based on their pros, cons, market cap, and use cases. This organizes your research and simplifies decision-making.

Top Coins for Beginners in 2025

Based on market trends and research, here are beginner-friendly coins for 2025. This is not financial advice—always do your own research:

- Bitcoin (BTC): The most stable and trusted crypto, often called “digital gold.” The US Strategic Bitcoin Reserve and ETF inflows have strengthened it, with a market cap over $1 trillion and a price around $94,780 (April 2025). Ideal for long-term investors.

- Ethereum (ETH): The leader in smart contracts and DeFi. The “Pectra” upgrade in March 2025 will enhance scalability, with a price around $2,200 and a market cap over $200 billion. Great for diversified portfolios.

- Solana (SOL): Known for fast, cheap transactions, popular in gaming and NFTs. Its market cap is ~$72 billion, but network outages are a risk. Good for high-growth seekers.

- XRP: Excels in cross-border payments. Post-2024 legal clarity, it’s a strong performer at ~$0.52. Suitable for those betting on regulatory progress.

- Polygon (MATIC): Ethereum’s layer-2 solution with low fees and partnerships (e.g., Disney, Starbucks). A solid pick for cost-conscious investors.

Note on Memecoins: Coins like Dogecoin or Shiba Inu offer high-return potential but are highly speculative, driven by hype. Beginners should allocate only a small portion of their portfolio to memecoins due to their volatility.

Common Research Mistakes and How to Avoid Them

Beginners often make these mistakes:

- Chasing Hype: Don’t invest blindly because a coin is trending on X. The 2021 Dogecoin hype led to significant losses when the market crashed. Cross-check trends with fundamentals.

- Relying on One Source: Avoid depending solely on X or a single website. Use multiple sources like whitepapers, CoinMarketCap, and news outlets for accuracy.

- Short-Term Focus: Crypto requires patience. Short-term profit-chasing can lead to losses. Set clear long-term goals like Priya in the earlier case study.

- Ignoring Scams: Fake projects and rug pulls are common. In 2023, a friend lost ₹30,000 in a hyped coin with no whitepaper and an anonymous team. Always verify team credibility and project legitimacy.

Example: The 2021 “Squid Game” coin scam lured investors with hype, only to crash when developers vanished. Proper research (checking the whitepaper and team) could have prevented losses.

Risk Management: How to Protect Your Investment

Crypto is volatile, so follow these risk management strategies:

- Diversify: Spread your investment across stable coins (Bitcoin, Ethereum), mid-cap coins (Polygon), and a small portion in high-risk coins (memecoins). For example, Aman invested ₹1 lakh in 2024: 50% in Bitcoin, 30% in Ethereum, and 20% in altcoins. When altcoins crashed, his portfolio stayed safe due to Bitcoin’s stability.

- Use Stop-Loss: For traders, set a stop-loss to limit losses (e.g., sell if a coin drops 10%). This is available on exchanges like Binance.

- Avoid Scams: Stick to trusted exchanges (Binance, Coinbase, WazirX) and avoid sending funds to unknown wallets. Check for red flags like anonymous teams or missing whitepapers.

- Track Taxes: In India, crypto profits face a 30% tax, and every transaction incurs a 1% TDS. Keep records to comply and avoid penalties.

How to Start Investing in Crypto

- Choose an Exchange: Use trusted platforms like Binance, Coinbase, or WazirX for buying and selling.

- Set Up a Wallet: Store coins securely in a hardware wallet (e.g., Ledger) or software wallet (e.g., MetaMask).

- Invest Gradually: Use Dollar Cost Averaging (DCA) to invest small amounts monthly, reducing the impact of volatility.

- Track Investments: Use apps like Blockfolio or Delta to monitor your portfolio.

Actionable Takeaway: Your Research Plan

Crypto success hinges on research. Understand each coin’s purpose, team, technology, market cap, and regulatory status. Use tools like CoinMarketCap, whitepapers, and X (with caution) to stay informed. In 2025, Bitcoin, Ethereum, Solana, XRP, and Polygon are solid options, but align your choices with your goals and risk tolerance.

Your Next Steps:

- Write down: Which 3 coins will you research? Where will you check their whitepapers and communities? What’s your budget and time horizon?

- This plan keeps you focused. If you need a deep dive on a specific coin (e.g., SUI, XRP, or Bitcoin), let me know, and I’ll analyze it with current data!

Specific Clarity Needed? If you want more details on SUI’s inflows, Trump’s reserve, India’s tax impact, or XRP’s legal journey, or if you have a personal budget/time horizon to discuss, share details, and I’ll tailor the response. Which coin or topic do you want to explore further?

FAQs: Aapke Common Sawalon Ke Jawab

How much money is safe to invest in crypto?

Invest only what you can afford to lose. For beginners, 5-10% of your savings is a good starting point. Is Bitcoin still a good investment?

Yes, Bitcoin is stable and trusted, but its growth may be slower compared to altcoins. Which exchange is best for beginners?

WazirX and CoinDCX are popular in India due to their simple interfaces and Indian rupee support. Is investing in memecoins safe?

Memecoins are high-risk. You can try a small amount, but thorough research is essential. How to avoid crypto scams?

Don’t click unknown links, use trusted platforms,

Conclusion:

The crypto market is a roller-coaster—full of ups and downs. But with smart investing, it can be a game-changer. In 2025, opportunities abound, but research and patience are key. Keep your goals clear, take calculated risks, and never stop learning. So why wait? Plan your first crypto investment today and become part of this exciting future!

Next Steps: Ready to start? Pick 1-3 coins to research (e.g., Bitcoin, Ethereum, Solana), check their whitepapers on official websites, and monitor sentiment on X or Reddit (cross-checking with CoinMarketCap). Define your budget, time horizon, and risk tolerance. If you need help analyzing a specific coin or setting up a plan, let me know—I can dive deeper with current data or tailor advice to your goals! What’s your first move?